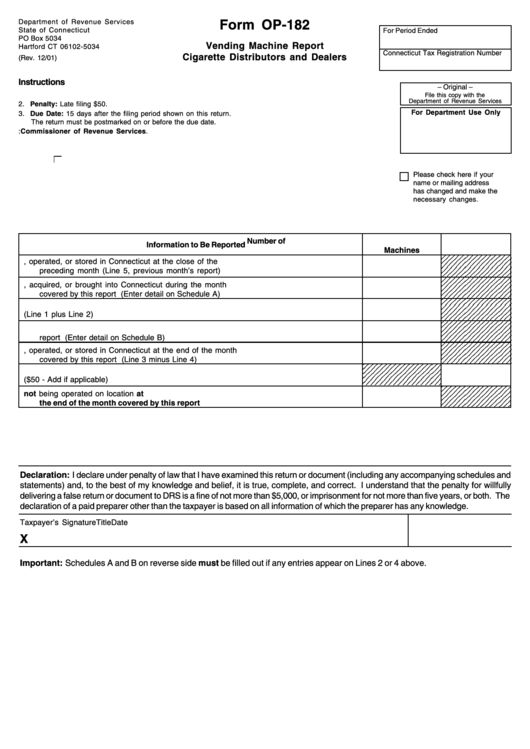

Form Op-182 - Vending Machine Report Cigarette Distributors And Dealers - Department Of Revenue Services

ADVERTISEMENT

Department of Revenue Services

Form OP-182

State of Connecticut

For Period Ended

PO Box 5034

Vending Machine Report

Hartford CT 06102-5034

Connecticut Tax Registration Number

Cigarette Distributors and Dealers

(Rev. 12/01)

Instructions

– Original –

1. You must file a report even if no machines were acquired or disposed of during this reporting period.

File this copy with the

Department of Revenue Services

2. Penalty: Late filing $50.

For Department Use Only

3. Due Date: 15 days after the filing period shown on this return.

The return must be postmarked on or before the due date.

4. Make check or money order payable to: Commissioner of Revenue Services.

Please check here if your

name or mailing address

has changed and make the

necessary changes.

Number of

Information to Be Reported

Machines

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1.

Vending machines owned, operated, or stored in Connecticut at the close of the

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

preceding month (Line 5, previous month’s report)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

2.

Vending machines purchased, acquired, or brought into Connecticut during the month

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

covered by this report (Enter detail on Schedule A)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

3.

Total accountable machines for month covered by this report (Line 1 plus Line 2)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

4.

Vending machines sold or otherwise disposed of during the month covered by this

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

report (Enter detail on Schedule B)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

5.

Vending machines owned, operated, or stored in Connecticut at the end of the month

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

covered by this report (Line 3 minus Line 4)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

6.

Penalty for late filing ($50 - Add if applicable)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

7.

Number of machines reported on Line 5 which were not being operated on location at

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

the end of the month covered by this report

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Declaration: I declare under penalty of law that I have examined this return or document (including any accompanying schedules and

statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully

delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The

declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s Signature

Title

Date

X

Important: Schedules A and B on reverse side must be filled out if any entries appear on Lines 2 or 4 above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2