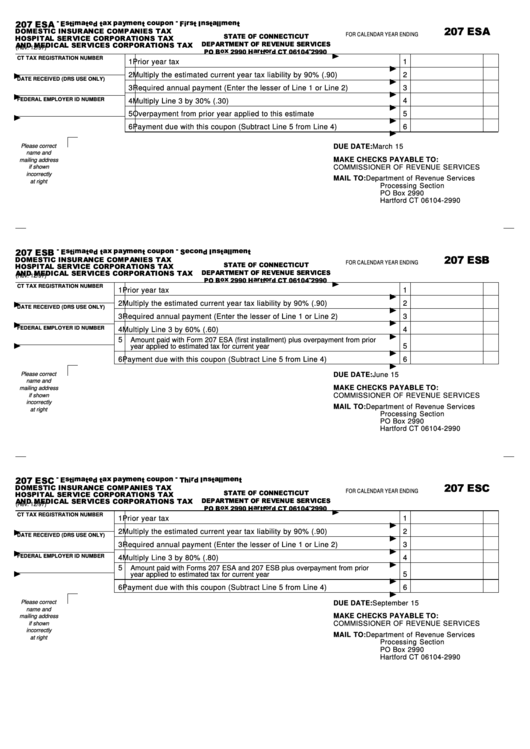

FOR CALENDAR YEAR ENDING

(Rev. 12/97)

CT TAX REGISTRATION NUMBER

1

Prior year tax

1

2

Multiply the estimated current year tax liability by 90% (.90)

2

DATE RECEIVED (DRS USE ONLY)

3

Required annual payment (Enter the lesser of Line 1 or Line 2)

3

FEDERAL EMPLOYER ID NUMBER

4

Multiply Line 3 by 30% (.30)

4

5

Overpayment from prior year applied to this estimate

5

6

Payment due with this coupon (Subtract Line 5 from Line 4)

6

Please correct

DUE DATE:

March 15

name and

MAKE CHECKS PAYABLE TO:

mailing address

COMMISSIONER OF REVENUE SERVICES

if shown

incorrectly

MAIL TO:

Department of Revenue Services

at right

Processing Section

PO Box 2990

Hartford CT 06104-2990

FOR CALENDAR YEAR ENDING

(Rev. 12/97)

CT TAX REGISTRATION NUMBER

1

Prior year tax

1

2

Multiply the estimated current year tax liability by 90% (.90)

2

DATE RECEIVED (DRS USE ONLY)

3

Required annual payment (Enter the lesser of Line 1 or Line 2)

3

FEDERAL EMPLOYER ID NUMBER

4

Multiply Line 3 by 60% (.60)

4

5

Amount paid with Form 207 ESA (first installment) plus overpayment from prior

year applied to estimated tax for current year

5

6

Payment due with this coupon (Subtract Line 5 from Line 4)

6

Please correct

DUE DATE:

June 15

name and

MAKE CHECKS PAYABLE TO:

mailing address

COMMISSIONER OF REVENUE SERVICES

if shown

incorrectly

MAIL TO:

Department of Revenue Services

at right

Processing Section

PO Box 2990

Hartford CT 06104-2990

FOR CALENDAR YEAR ENDING

(Rev. 12/97)

CT TAX REGISTRATION NUMBER

1

Prior year tax

1

2

Multiply the estimated current year tax liability by 90% (.90)

2

DATE RECEIVED (DRS USE ONLY)

3

Required annual payment (Enter the lesser of Line 1 or Line 2)

3

FEDERAL EMPLOYER ID NUMBER

4

Multiply Line 3 by 80% (.80)

4

5

Amount paid with Forms 207 ESA and 207 ESB plus overpayment from prior

year applied to estimated tax for current year

5

6

Payment due with this coupon (Subtract Line 5 from Line 4)

6

Please correct

DUE DATE:

September 15

name and

MAKE CHECKS PAYABLE TO:

mailing address

if shown

COMMISSIONER OF REVENUE SERVICES

incorrectly

MAIL TO:

Department of Revenue Services

at right

Processing Section

PO Box 2990

Hartford CT 06104-2990

1

1 2

2