Form Op-182 - Vending Machine Report Cigarette Distributors And Dealers - Department Of Revenue Services Page 2

ADVERTISEMENT

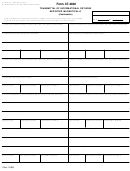

Schedule A

Vending machines purchased, acquired, or brought into Connecticut during this reporting month:

*Sales

Purchase

Premises Where Machine Is Located

From Whom Acquired

Date

Qty

Manufacturer

Model

Tax

Price

(Name and Address)

(Name and Address)

Paid

* Fill in this column: Use “V” if the tax was paid to vendor; Use “S” if the tax was paid directly by you to the State of Connecticut and reported on

Total

(Should agree with Page 1, Line 2)

a return; Use “O” if tax was not paid and explain fully below.

Explain here if tax was not paid:

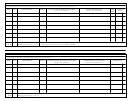

Schedule B

Description of vending machines sold or otherwise disposed of:

Premises Where Machine Was Located

To Whom Sold or Transferred

Date

Qty

Manufacturer

Model

Selling Price

(Name and Address)

(Name and Address)

Total

(Should agree with Page 1, Line 4)

OP-182 (Rev. 12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2