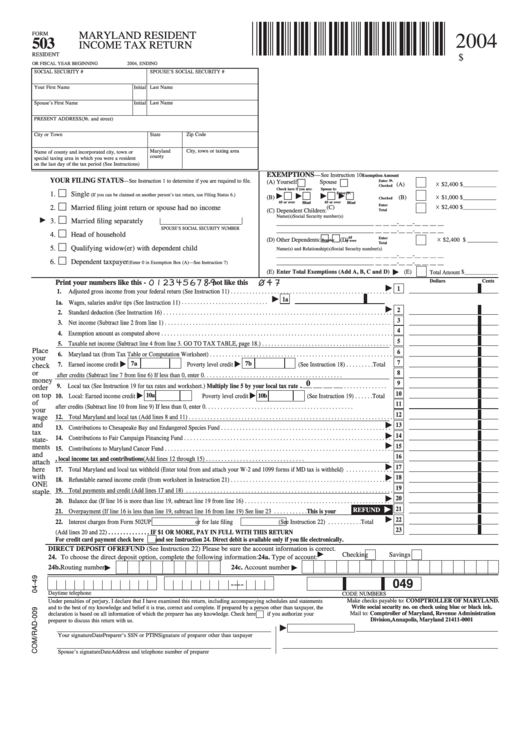

MARYLAND RESIDENT

FORM

2004

503

INCOME TAX RETURN

RESIDENT

$

OR FISCAL YEAR BEGINNING

2004, ENDING

SOCIAL SECURITY #

SPOUSE’S SOCIAL SECURITY #

Your First Name

Last Name

Initial

Spouse’s First Name

Initial

Last Name

PRESENT ADDRESS (No. and street)

Zip Code

City or Town

State

Maryland

City, town or taxing area

Name of county and incorporated city, town or

county

special taxing area in which you were a resident

on the last day of the tax period (See Instructions)

EXEMPTIONS

—

See Instruction 10

Exemption Amount

YOUR FILING STATUS

—

See Instruction 1 to determine if you are required to file.

Enter No.

(A) Yourself

Spouse

(A)

$2,400 $ ___________

Checked

Check here if you are:

Spouse is:

1.

Single

Enter No.

(If you can be claimed on another person’s tax return, use Filing Status 6.)

(B)

(B)

$1,000 $ ___________

Checked

65 or over

Blind

65 or over

Blind

Enter

2.

Married filing joint return or spouse had no income

(C)

$2,400 $ ___________

(C) Dependent Children:

Total

Name(s)

Social Security number(s)

3.

Married filing separately

________________________________ __ __ __-__ __-__ __ __ __

SPOUSE’S SOCIAL SECURITY NUMBER

________________________________ __ __ __-__ __-__ __ __ __

4.

Head of household

65

Enter

(D) Other Dependents:

(D)

$2,400 $ __________

Regular

or over

Total

5.

Qualifying widow(er) with dependent child

Name(s) and Relationship(s)

Social Security number(s)

________________________________ __ __ __-__ __-__ __ __ __

6.

Dependent taxpayer

________________________________ __ __ __-__ __-__ __ __ __

(Enter 0 in Exemption Box (A)—See Instruction 7 )

(E) Enter Total Exemptions (Add A, B, C and D)

(E)

$___________

Total Amount

Dollars

Cents

Print your numbers like this -

- not like this

1

1.

Adjusted gross income from your federal return (See Instruction 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

1a. Wages, salaries and/or tips (See Instruction 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Standard deduction (See Instruction 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Net income (Subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Exemption amount as computed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Taxable net income (Subtract line 4 from line 3. GO TO TAX TABLE, page 18.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Place

6

6. Maryland tax (from Tax Table or Computation Worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

your

7

7a

7b

7. Earned income credit

Poverty level credit

(See Instruction 18) . . . . . . . . .Total

check

or

8

8. Maryland tax after credits (Subtract line 7 from line 6) If less than 0, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

money

.

0

9

___ ___ ___ ___ . . . . . . . . . . . . . .

9. Local tax (See Instruction 19 for tax rates and worksheet.) Multiply line 5 by your local tax rate

order

10

on top

10a

10. Local: Earned income credit

Poverty level credit

10b

(See Instruction 19) . . . . . .Total

of

11

11. Local tax after credits (Subtract line 10 from line 9) If less than 0, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

your

12

wage

12. Total Maryland and local tax (Add lines 8 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

and

13

13. Contributions to Chesapeake Bay and Endangered Species Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

tax

14

14. Contributions to Fair Campaign Financing Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

state-

15

ments

15. Contributions to Maryland Cancer Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

and

16

16. Total Maryland income tax, local income tax and contributions (Add lines 12 through 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

attach

17

here

17. Total Maryland and local tax withheld (Enter total from and attach your W-2 and 1099 forms if MD tax is withheld) . . . . . . . . . . . . . . .

with

18

18. Refundable earned income credit (from worksheet in Instruction 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ONE

19

19. Total payments and credit (Add lines 17 and 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

staple.

20

20. Balance due (If line 16 is more than line 19, subtract line 19 from line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

REFUND

21. Overpayment (If line 16 is less than line 19, subtract line 16 from line 19) See line 23 . . . . . . . . . . .This is your

22

22. Interest charges from Form 502UP

or for late filing

(See Instruction 22) . . . . . . . . . . .Total

23

23. TOTAL AMOUNT DUE (Add lines 20 and 22) . . . . . . . . . . . . . . IF $1 OR MORE, PAY IN FULL WITH THIS RETURN

For credit card payment check here

and see Instruction 24. Direct debit is available only if you file electronically.

DIRECT DEPOSIT OF REFUND (See Instruction 22) Please be sure the account information is correct.

Checking

Savings

24. To choose the direct deposit option, complete the following information:

24a. Type of account:

24b. Routing number

24c. Account number

049

-

-

-

-

Daytime telephone no.

Home telephone no.

CODE NUMBERS

Make checks payable to: COMPTROLLER OF MARYLAND.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements

Write social security no. on check using blue or black ink.

and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the

Mail to: Comptroller of Maryland, Revenue Administration

declaration is based on all information of which the preparer has any knowledge. Check here

if you authorize your

Division, Annapolis, Maryland 21411-0001

preparer to discuss this return with us.

Your signature

Date

Preparer’s SSN or PTIN

Signature of preparer other than taxpayer

Spouse’s signature

Date

Address and telephone number of preparer

1

1 2

2