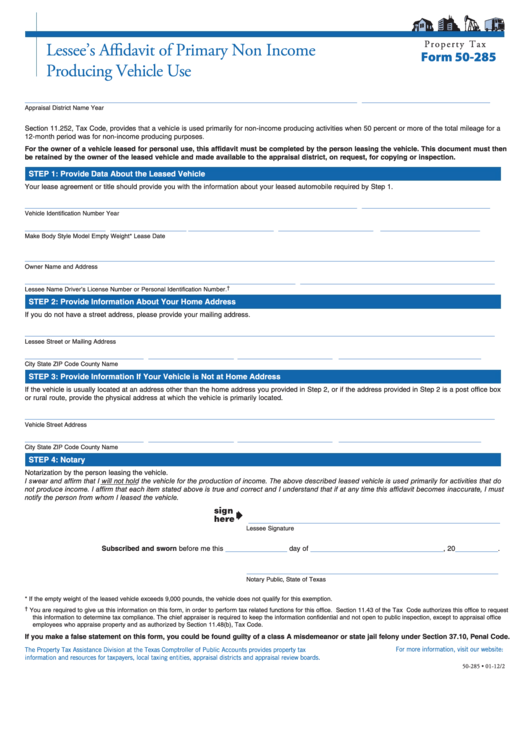

P r o p e r t y T a x

Lessee’s Affidavit of Primary Non Income

Form 50-285

Producing Vehicle Use

______________________________________________________________________

___________________________

Appraisal District Name

Year

Section 11.252, Tax Code, provides that a vehicle is used primarily for non-income producing activities when 50 percent or more of the total mileage for a

12-month period was for non-income producing purposes.

For the owner of a vehicle leased for personal use, this affidavit must be completed by the person leasing the vehicle. This document must then

be retained by the owner of the leased vehicle and made available to the appraisal district, on request, for copying or inspection.

STEP 1: Provide Data About the Leased Vehicle

Your lease agreement or title should provide you with the information about your leased automobile required by Step 1.

______________________________________________________________________

___________________________

Vehicle Identification Number

Year

_________________ ________________

__________________

____________________

_____________________

Make

Body Style

Model

Empty Weight*

Lease Date

___________________________________________________________________________________________________

Owner Name and Address

_________________________________________________________ _________________________________________

†

Lessee Name

Driver’s License Number or Personal Identification Number.

STEP 2: Provide Information About Your Home Address

If you do not have a street address, please provide your mailing address.

___________________________________________________________________________________________________

Lessee Street or Mailing Address

_________________________

__________________

____________________

______________________________

City

State

ZIP Code

County Name

STEP 3: Provide Information If Your Vehicle is Not at Home Address

If the vehicle is usually located at an address other than the home address you provided in Step 2, or if the address provided in Step 2 is a post office box

or rural route, provide the physical address at which the vehicle is primarily located.

___________________________________________________________________________________________________

Vehicle Street Address

_________________________

__________________

____________________

______________________________

City

State

ZIP Code

County Name

STEP 4: Notary

Notarization by the person leasing the vehicle.

I swear and affirm that I will not hold the vehicle for the production of income. The above described leased vehicle is used primarily for activities that do

not produce income. I affirm that each item stated above is true and correct and I understand that if at any time this affidavit becomes inaccurate, I must

notify the person from whom I leased the vehicle.

_____________________________________________________

Lessee Signature

_____________

____________________________

_________

Subscribed and sworn before me this

day of

, 20

.

_____________________________________________________

Notary Public, State of Texas

* If the empty weight of the leased vehicle exceeds 9,000 pounds, the vehicle does not qualify for this exemption.

†

You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax Code authorizes this office to request

this information to determine tax compliance. The chief appraiser is required to keep the information confidential and not open to public inspection, except to appraisal office

employees who appraise property and as authorized by Section 11.48(b), Tax Code.

If you make a false statement on this form, you could be found guilty of a class A misdemeanor or state jail felony under Section 37.10, Penal Code.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-285 • 01-12/2

1

1