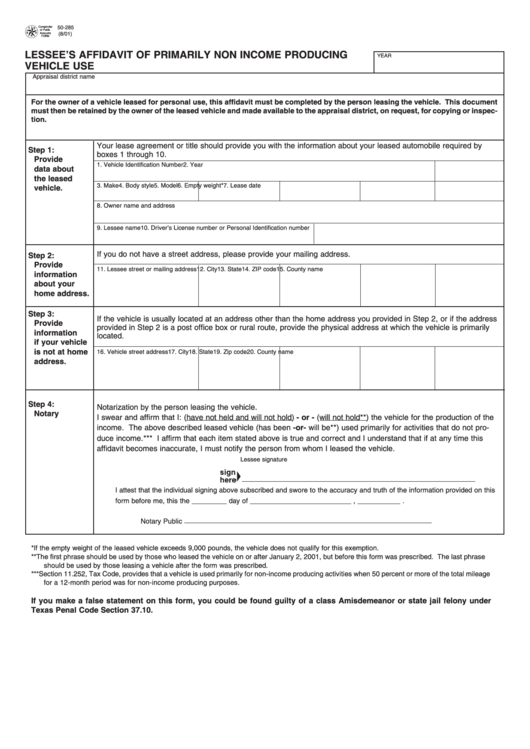

Form 50-285 - Lessee'S Affidavit Of Primarily Non Income Producing Vehicle Use - 2001

ADVERTISEMENT

Comptroller

50-285

T

E

of Public

S

X

Accounts

(8/01)

A

FORM

LESSEE’S AFFIDAVIT OF PRIMARILY NON INCOME PRODUCING

YEAR

VEHICLE USE

Appraisal district name

For the owner of a vehicle leased for personal use, this affidavit must be completed by the person leasing the vehicle. This document

must then be retained by the owner of the leased vehicle and made available to the appraisal district, on request, for copying or inspec-

tion.

Your lease agreement or title should provide you with the information about your leased automobile required by

Step 1:

boxes 1 through 10.

Provide

1. Vehicle Identification Number

2. Year

data about

the leased

3. Make

4. Body style

5. Model

6. Empty weight*

7. Lease date

vehicle.

8. Owner name and address

9. Lessee name

10. Driver’s License number or Personal Identification number

If you do not have a street address, please provide your mailing address.

Step 2:

Provide

11. Lessee street or mailing address 12. City

13. State

14. ZIP code

15. County name

information

about your

home address.

Step 3:

If the vehicle is usually located at an address other than the home address you provided in Step 2, or if the address

Provide

provided in Step 2 is a post office box or rural route, provide the physical address at which the vehicle is primarily

information

located.

if your vehicle

is not at home

16. Vehicle street address

17. City

18. State

19. Zip code

20. County name

address.

Step 4:

Notarization by the person leasing the vehicle.

Notary

I swear and affirm that I: (have not held and will not hold) - or - (will not hold**) the vehicle for the production of the

income. The above described leased vehicle (has been -or- will be**) used primarily for activities that do not pro-

duce income.*** I affirm that each item stated above is true and correct and I understand that if at any time this

affidavit becomes inaccurate, I must notify the person from whom I leased the vehicle.

Lessee signature

I attest that the individual signing above subscribed and swore to the accuracy and truth of the information provided on this

form before me, this the _________ day of __________________________ , ___________ .

Notary Public

*

If the empty weight of the leased vehicle exceeds 9,000 pounds, the vehicle does not qualify for this exemption.

** The first phrase should be used by those who leased the vehicle on or after January 2, 2001, but before this form was prescribed. The last phrase

should be used by those leasing a vehicle after the form was prescribed.

*** Section 11.252, Tax Code, provides that a vehicle is used primarily for non-income producing activities when 50 percent or more of the total mileage

for a 12-month period was for non-income producing purposes.

If you make a false statement on this form, you could be found guilty of a class A misdemeanor or state jail felony under

Texas Penal Code Section 37.10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1