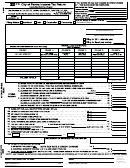

City Of Auburn Tax Return Form Page 2

ADVERTISEMENT

activity apply exclusively to the purpose for which

the privilege of operating said business within the

ADMISSIONS TAX (ACC 3.52)

tax exempt status was granted.

city. The tax shall be due and payable quarterly on or

A tax of one cent on $0.20 or fraction thereof

before the last day of the month following each

shall be paid by the person who pays an

quarterly period. A 10% late penalty shall be added

The person or organization which receives any

admission charge to any place within the city

.

payment for an admission charge on which a tax is

to taxes left unpaid 30 days following the due date

limits including those admitted free of charge or

levied, shall collect the tax and report and remit the

at a reduced rate for which others pay a charge

tax to the Finance Director on a monthly basis on or

Telephone (ACC Chapter 3.84)

for the same privileges. An admission charge is

before the 15th of the following month. Delinquent

Persons, firms, or corporations engaged in a

defined to include:

taxes are subject to interest at the rate of 1% per

telephone business as defined in Section 5.84.010 of

Charge made for season tickets or subscriptions;

month or fraction thereof for each month the taxes

the Auburn City Code shall pay a 6% tax on the total

A cover charge or a charge made for the use of

remain unpaid.

gross operating revenues including revenues from

seats or tables reserved or otherwise, and similar

intrastate tolls derived from the operation of such

accommodations;

GAMBLING TAXES

business within the city. The tax shall be due and

A charge made for rental or use of equipment or

payable quarterly on or before the 30th day of the

(ACC 3.80 and RCW 9.46)

facilities for purposes of recreation or amusement,

month following the end of each quarter. A 10% late

Gambling taxes shall be paid to the City of Auburn

and where the rental of the equipment or facilities

penalty shall be added to taxes left unpaid 30 days

Finance Director on a quarterly basis and upon the

is necessary to the enjoyment of the privilege for

following the due date.

filing of a duplicate copy of the Washington State

which general admission is charged, the combined

Gambling Commission Quarterly Activity Report.

charge shall be the admission charge;

Cable System (ACC Chapters 3.42 and 13.36)

A charge made for admission to any theater,

No city tax shall be imposed on bingo or amusement

Any company granted a franchise to construct,

cabaret, tavern, dance hall, amphitheater, private

games when such activities or a combination thereof

operate, and maintain a cable communications

club, auditorium, observation tower, stadium,

are conducted by any bona fide charitable or

system within the city shall pay to the city on a

athletic pavilion or field, baseball or athletic park,

nonprofit

organization,

as

defined

by

RCW

quarterly basis a sum equal to 5% or greater of gross

golf course, or any similar place, and includes

9.46.020(3)

of

the

laws

of

the state, which

revenues as defined in ACC Chapter 13.36.230.

equipment to which person are admitted for

organization has not paid operating or management

There is levied a utility tax in the amount of one

purposes of recreation such as merry-go-rounds,

personnel and has gross income from bingo or

percent to be levied on and after July 1, 2008, of the

ferris wheels, dodge’ems, roller coaster, go carts

amusement games, or a combination thereof, not

gross receipts against and upon the total annual

and other rides, whether such rides are restricted to

exceeding $5,000 per year, less the amount paid for

revenues of cable television businesses operating

tracks or not;

as prizes.

No tax shall be imposed on the first

within the city.

Charge made for automobile parking where the

$10,000 of net proceeds from raffles conducted by

amount of the charge is determined according to

any bona fide charitable or nonprofit organization. If

Solid Waste (ACC Chapter 3.41)

the number of passengers in an automobile;

you believe your organization is exempt from

Persons, firms, or corporations engaged in the

A sum of money referred to as a “donation” which

gambling tax, please contact the City Clerk for more

handling of solid waste shall pay to the city on a

must be paid before entrance is allowed;

information.

If your organization is exempt from

quarterly basis a sum equal to 7% of the total gross

The amount of an increase in the price of

gambling tax, please file a tax report form showing

operating revenue.

Solid waste is defined as

refreshments, service or merchandise in a place if

the activity even though the activity is not taxed.

garbage, recyclables and yard debris (compostables).

no fixed admission charge or cover charge is

imposed, but the price charged for refreshments,

Any person violating or failing to comply with the

service or merchandise is higher during the time

provisions of Auburn City Code Chapter 3.80 is

entertainment or dancing is provided than at other

subject to the penalties described in Auburn City

times.

Code Section 3.80.090.

Exemptions include:

Any activity of elementary or secondary school;

UTILITY TAXES

Any activity which is $0.50 or less;

Any activity of a nonprofit corporation, trust, society,

order, institution, organization, or association

Gas & Electricity (ACC Chapter 3.88)

exclusively engaged in or devoted to any religious,

Persons, firms or corporations engaged in an electric

charitable, scientific, literary, educational, public or

power business, natural gas business and/or artificial

other like work, where the net earnings of such

gas business within or partly within the city limits shall

pay a 6% tax on total gross revenues to the city for

Revised July 1, 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2