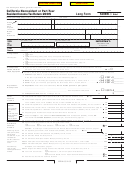

Form Ct-1040nr/py - Nonresident Or Part-Year Resident Income Tax Return - 2003 Page 2

ADVERTISEMENT

Schedule 1

Modifications to Federal Adjusted Gross Income (enter all amounts as positive numbers)

!

32. Interest on state and local government obligations other than Connecticut

32

00

!

00

33. Mutual fund exempt-interest dividends from non-Connecticut state or municipal government obligations

33

Additions

!

34. Special depreciation allowance for qualified property placed in service during this year

34

00

to Federal

!

00

35. Taxable amount of lump-sum distributions from qualified plans not included in federal adjusted gross income

Adjusted

35

Gross Income

!

00

36. Beneficiary’s share of Connecticut fiduciary adjustment (Enter only if greater than zero)

36

(See instructions,

!

37. Loss on sale of Connecticut state and local government bonds

00

37

Page 18)

!

00

38. Other - specify ____________________________________________________________________

38

!

39. TOTAL ADDITIONS (Add Lines 32 through 38) Enter here and on Line 2.

00

39

!

00

40. Interest on United States government obligations

40

!

41. Exempt dividends from certain qualifying mutual funds derived from United States government obligations

00

41

!

42. Social Security benefit adjustment (See Social Security Benefit Adjustment Worksheet, Page 19)

00

42

Subtractions

!

From Federal

00

43. Refunds of state and local income taxes

43

Adjusted

!

44. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities

00

44

Gross Income

!

00

45. Special depreciation allowance for qualified property placed in service during the preceding year

45

(See instructions,

!

46. Beneficiary’s share of Connecticut fiduciary adjustment (Enter only if less than zero)

00

Page 19)

46

!

00

47. Gain on sale of Connecticut state and local government bonds

47

!

00

48. Other - specify (Do not include out-of-state income) ______________________________________

48

!

49. TOTAL SUBTRACTIONS (Add Lines 40 through 48) Enter here and on Line 4.

00

49

Credit for Income Taxes Paid to Qualifying Jurisdictions (for Part-Year Residents Only)

Schedule 2

!

50. Connecticut AGI during the residency portion of the taxable year (See instructions, Page 23)

50

00

FOR EACH COLUMN, ENTER THE FOLLOWING:

COLUMN A

COLUMN B

Important:

Name

Code

Name

Code

You must

!

!

51. Enter qualifying jurisdiction’s name and two-letter code (See instructions, Page 23)

51

attach a copy

52. Non-Connecticut income included on Line 50 and reported on a qualifying

of your return

!

!

00

00

jurisdiction’s income tax return (Complete Schedule 2 Worksheet , Page 22)

52

filed with the

!

!

53. Divide Line 52 by Line 50 (may not exceed 1.0000)

53

qualifying

#

#

!

!

jurisdiction(s)

00

00

54. Apportioned income tax (See instructions, Page 23)

54

or your credit

!

!

55. Multiply Line 53 by Line 54

55

00

00

will be

!

!

00

00

56. Income tax paid to a qualifying jurisdiction (See instructions, Page 23)

56

disallowed.

!

!

57. Enter the lesser of Line 55 or Line 56

00

00

57

!

00

58. TOTAL CREDIT (Add Line 57, all columns) Enter here and on Line 11.

58

Schedule 3

Contributions of Refund to Designated Charities (See instructions, Page 24)

!

!

!

!

!

!

!

!

AIDS Research

___ $2

__ $5

_ $15

other ___ .00

Breast Cancer Research

___ $2

__ $5

_ $15

other ___ .00

!

!

!

!

!

!

!

!

Organ Transplant

___ $2

__ $5

_ $15

other ___ .00

Safety Net Services

___ $2

__ $5

_ $15

other ___ .00

!

!

!

!

Endangered Species/Wildlife

___ $2

__ $5

_ $15

other ___ .00

00

59. TOTAL CONTRIBUTIONS. Enter here and on Line 25.

59

Due Date: April 15, 2004

Make your check or money order payable to: “Commissioner of Revenue Services”

To ensure proper posting of your payment, write your Social Security Number(s) and “2003 Form CT-1040NR/PY” on your check or money order.

Attach a copy of all applicable schedules and forms to this return. Use envelope provided with correct mailing label, or mail to:

For refunds and all other tax forms without payment:

For all tax forms with payment:

Department of Revenue Services

Department of Revenue Services

PO Box 2968

PO Box 2969

Hartford CT 06104-2968

Hartford CT 06104-2969

!

!

Do you authorize DRS to contact another person about this return? ( See Page 17)

Yes. Complete the following.

No

Third Party

Designee’s Name

Telephone Number

Personal Identification

Designee

(

)

Number (PIN)

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for

not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Your Signature

Date

Daytime Telephone Number

Sign Here

(

)

Keep a copy

Spouse’s Signature (if joint return)

Date

Daytime Telephone Number

for your

(

)

records.

Paid Preparer’s Signature

Date

Telephone Number

Preparer’s SSN or PTIN

(

)

Firm’s Name, Address, and ZIP Code

FEIN

CT-1040NR/PY Back (Rev. 12/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2