MONTANA

PT-WH

Rev. 9-04

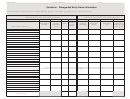

2004 Montana Income Tax Withheld

for a Nonresident Individual, Foreign C. Corporation,

or Second-Tier Pass-Through Entity

Owner Information

First-Tier Pass-Through Entity’s Information as shown on

most recent federal return or Schedule K-1

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Social Security Number or Federal Employer ID Number

Federal Employer ID Number

1.

Owner’s Montana source income reflected on

First-Tier Pass-Through Entity Type (check only one)

the first-tier pass-through entity’s

$___________

information return........................................

S. Corporation

Partnership

Disregarded Entity

2.

Amount of Montana tax withheld and

remitted (11% of line 1 if a nonresident

Taxable year of first-tier pass-through entity

individual or a second-tier pass-through entity.

$___________

Beginning________, 20____and ending________, 20____

6.75% of line 1 if a foreign C. corporation ).....

To be completed in absence of an owners participation in a composite return or submitting a signed Montana

Form PT-AGR or PT-STM.

.

Instructions

Purpose of Form PT-WH

an estimated payment against your Montana individual

A first-tier pass-through entity that has a nonresident

income tax liability. When completing your Montana

individual, foreign C. corporation, or second-tier pass

individual income tax return, Form 2, the amount in box 2

through entity owner at any time during the tax year must

above is claimed as an estimated payment on line 56 of

remit amounts to the Department of Revenue on behalf of

your 2004 Montana Form 2. Form PT-WH must be

the owner as provided in 15-30-1113, Montana Code

attached to your Montana Form 2 when claiming this

Annotated, if (1) the entity does not have a valid, currently

estimated payment.

effective tax agreement or statement from the owner and (2)

the owner does not participate in filing a composite return

Foreign C. Corporation

with the entity.

The amount of Montana income tax withheld is considered

an estimated payment against your Montana corporation

Amount of Withholding

license tax liability. When completing your Montana

For a nonresident individual and a second-tier pass-through

corporation license tax return, Form CLT-4, the amount in

entity, the amount withheld is 11% of the Montana source

box 2 above is claimed as an estimated payment on line

income reflected on the entity’s Montana information return.

11b of your 2004 Montana Form CLT-4. Form PT-WH must

For a foreign C. corporation, the amount withheld is 6.75%

be attached to your Montana Form CLT-4 when claiming

of the Montana source income reflected on the entity’s

this estimated payment.

Montana information return.

Second-Tier Pass-Through Entity

First-Tier Pass-Through Entity filing

The amount of Montana income tax withheld is considered

Transfer amounts reported on lines 1 and 2 above to Form

an estimated payment on the account of the individual,

CLT-4S, PR-1, or DER-1; Schedule V. Send Form PT-WH

estate, trust or C. corporation in which the Montana source

to its owner. Form PT-WH is not required to be submitted

income of the first-tier pass-through entity’s income is

to the Department of Revenue with the pass-through entity

directly or indirectly passed through and is claimed as a

information return, Schedule V.

distributable share of a refundable credit when an

individual, estate, trust or C. corporation files a Montana

Nonresident Individual

tax return and is subject to tax on the Montana source

The amount of Montana income tax withheld is considered

income.

1

1 2

2 3

3