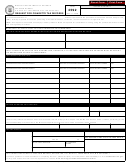

INSTRUCTIONS FOR AFFIDAVIT FOR BAD DEBT LOSS

Instructions

This form is to be completed when claiming credit for tax accrued and remitted to the state but not received from an eligible purchaser. In order to receive this credit, the supplier must

have notified the state of failure to collect the tax within ten (10) business days following the earliest date on which the supplier was entitled to collect the tax from the eligible purchaser

pursuant to Section 142.848, RSMo. Notification must be submitted by completing a Form 4760, Supplier Notification of Uncollectible Tax.

This form is to be completed and returned with the supplier’s first monthly tax report following the ten-day notification period.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov. You may also access the department’s web site at

to obtain this form.

General Instructions

Round to whole dollars.

Supplier name, address, FEIN, and license number —

Enter the name, numbers, and information for the supplier.

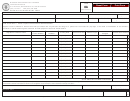

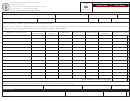

Eligible Purchaser and Sale information —

Enter the name of the defaulting eligible purchaser and details for each transaction for which payment has not been received.

Use a separate line for tax, inspection fee, transport load fee, and pool bond contribution.

The affidavit must be signed and dated by the supplier.

The credit is to be claimed on the first return following the expiration of the ten-day period.

Credit is limited to the amount due from the purchaser, plus any tax that accrues from that purchaser for a period not to exceed ten (10) days or the date of notification to the director or

whichever is earlier, following the date of failure to pay.

Print name, sign, and date the form.

MO 860-1109 (11-2006)

DOR-571 (11-2006)

1

1 2

2