Vending Machine Worksheet - Washington Department Of Revenue

ADVERTISEMENT

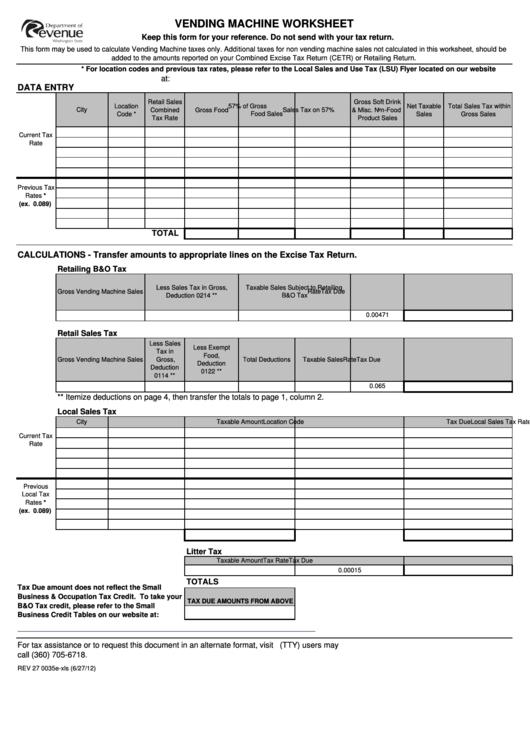

VENDING MACHINE WORKSHEET

Keep this form for your reference. Do not send with your tax return.

This form may be used to calculate Vending Machine taxes only. Additional taxes for non vending machine sales not calculated in this worksheet, should be

added to the amounts reported on your Combined Excise Tax Return (CETR) or Retailing Return.

* For location codes and previous tax rates, please refer to the Local Sales and Use Tax (LSU) Flyer located on our website

at:

DATA ENTRY

Retail Sales

Gross Soft Drink

Location

57% of Gross

Net Taxable

Total Sales Tax within

City

Combined

Gross Food

Sales Tax on 57%

& Misc. Non-Food

Code *

Food Sales

Sales

Gross Sales

Tax Rate

Product Sales

Current Tax

Rate

Previous Tax

Rates *

(ex. 0.089)

TOTAL

CALCULATIONS - Transfer amounts to appropriate lines on the Excise Tax Return.

Retailing B&O Tax

Less Sales Tax in Gross,

Taxable Sales Subject to Retailing

Gross Vending Machine Sales

Rate

Tax Due

Deduction 0214 **

B&O Tax

0.00471

Retail Sales Tax

Less Sales

Less Exempt

Tax in

Food,

Gross Vending Machine Sales

Gross,

Total Deductions

Taxable Sales

Rate

Tax Due

Deduction

Deduction

0122 **

0114 **

0.065

** Itemize deductions on page 4, then transfer the totals to page 1, column 2.

Local Sales Tax

City

Location Code

Taxable Amount

Local Sales Tax Rate

Tax Due

Current Tax

Rate

Previous

Local Tax

Rates *

(ex. 0.089)

Litter Tax

Taxable Amount

Tax Rate

Tax Due

0.00015

TOTALS

Tax Due amount does not reflect the Small

Business & Occupation Tax Credit. To take your

TAX DUE AMOUNTS FROM ABOVE

B&O Tax credit, please refer to the Small

Business Credit Tables on our website at:

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype (TTY) users may

call (360) 705-6718.

REV 27 0035e-xls (6/27/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8