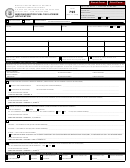

Distributors — List the suppliers from whom you purchase fuel, telephone number, Federal ID number, License

Number, Product Type, Terminal number where product is, how received.

( Example: ABC Oil Co, 555-555-5555, 44-4444444, S0000, diesel, T-43-MO-3700, Truck)

Transporters — List the companies for whom you haul fuel, telephone number, Federal ID Number, License

Number, product type, terminal number where product is received, transport method. ( Example: ABC Oil Co, 555-

555-5555, 44-4444444, D0000, gas, T-43-MO-3700, Truck)

Terminal Operators — List the companies that are position holders in your terminal, telephone number, Federal

ID Number, License Number, product type, terminal number where product is received, how product is received.

( Example: ABC Oil Co, 555-555-5555, 44-4444444, S0000, gas, 43-MO-3700, Pipeline/Barge)

Section 10 — Common Carrier Information

Provide the requested information for the companies that you hire to transport your fuel.

Section 11 — Conveyance Method

If you are a transporter, supplier or distributor transporting your own fuel or hauling for hire, check the appropriate box for

transport method. If you are using your own transport trucks, please provide the requested information. If you have a

tank wagon operation and wish to obtain tank wagon permits for your vehicles, please provide the requested

information and place a check mark in the "Tank Wagon" column. (Obtaining tank wagon permits allows you to

import fuel that the Missouri fuel tax and fees have not been precollected on, without calling for an import verifi-

cation number and without having to pay the fuel taxes and fees within three (3) days.)

Section 12 — Terminal Information

Suppliers — Provide the requested information for Missouri terminals in which you are a position holder and any out-of-

state terminal in which you are a position holder and will collect the Missouri tax on all removals destined to Missouri.

Permissive Suppliers — Provide the requested information for any out-of-state terminal in which you are a position

holder and agree to precollect the Missouri tax on all removals destined for Missouri.

Terminal Operators — Provide the requested information for the Missouri terminal you operate.

Section 13 — Notice of Election

Indicate if you are a position holder/supplier in an out-of-state terminal and agree to collect Missouri taxes and fees on all

removals destined for Missouri without regard to the license status of the person acquiring the motor fuel. If you make this

election, you must collect Missouri taxes and fees on all removals destined for Missouri from all terminals in which you

are a position holder.

Section 14 — Missouri Storage Tank Information

Please furnish the requested information for all storage tanks you have in Missouri. It is not necessary to list individual

tanks. Show the total storage capacity for each product type for each location.

Section 15 — Bond Information

Provide the estimated number of gallons you will handle for each activity and product type as listed.

Place a check mark in the box for each activity type you are applying for and the type of bond you are submitting. Bond

Amount is based on 3 times the monthly liability based on the number of all gallons handled.

All persons applying for more than one activity type must submit a separate bond for each activity. The only

exception is for suppliers and permissive suppliers. Only suppliers and permissive supplier may provide "proof

of financial responsibility" in lieu of filing a bond.

Transporters may meet the initial bonding requirement by posting a $1,500 bond. The director may request an increase

up to the maximum amount.

Distributors that were licensed prior to January 1, 1999, and were not required to provide a bond under the previous law

and distributors, licensed after January 1, 1999, who have 3 consecutive years of satisfactory tax compliance, may elect

to participate in the pool bond. Pool bond is calculated and paid on gallons handled, including gallons purchased for

export from Missouri.

Section 16 — Signature

Provide the requested information. The person signing the application must be listed in Section 6 or there must be a

power of attorney attached for the person signing. In addition the person whose signature appears in this section is

attesting that "Eligible Purchaser Status" was requested in Section 3.

1

1 2

2 3

3 4

4 5

5 6

6 7

7