Form Cd-419 - Application For Extension Franchise And Corporate Income Tax

ADVERTISEMENT

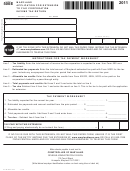

Application for Extension

CD-419

Web

Franchise and Corporate Income Tax

3-03

North Carolina Department of Revenue

Use Form CD-419 to request an extension of time to file a North Carolina C Corporation Tax Return (CD-405) or S Corporation Tax Return (CD-401S).

Form CD-419 consists of two separate applications. One application applies to income tax and one application applies to franchise tax. North Carolina

does not accept the federal extension in lieu of Form CD-419.

To obtain an extension, all taxpayers except nonprofit entities, HMOs, and cooperative or mutual associations must complete both the franchise and

the corporate income tax applications on this form and file the completed form by the original due date of the corporate tax return. Nonprofit entities,

HMOs, and cooperative or mutual associations are not subject to franchise tax and are therefore not required to complete the franchise tax portion of

this form. When timely filed, Form CD-419 extends the due date of the return by 7 months. An extension of time to file the return does not extend the

time to pay the amount of tax due. If you do not pay the full amount of tax due by the original due date of the return, interest and penalties will be assessed.

If you have difficulty using the personalized application for extension on the Department’s website, you can use the generic extension printed below.

The personalized web version of Form CD-419 prints specific taxpayer data on the applications that allows for faster processing with fewer errors.

The Department encourages the use of the personalized web version of Form CD-419.

If the amount of tax due is less than zero, enter zero.

Submit this form in its entirety. Do not separate the applications from the rest of the form.

Application for Extension

Franchise Tax

North Carolina Department of Revenue

Beginning Tax Year (MM-DD-YY)

Ending Tax Year (MM-DD-YY)

Federal Employer ID Number

N.C. Secretary of State ID Number

Enter Whole U.S. Dollars Only

Legal Name (First 35 Characters)

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

1. Total Franchise

,

,

$

Tax Due

.

00

Minimum Tax

Address

$35.00

City

State

Zip Code

Mail to: N.C. Department of Revenue

P.O. Box 25000, Raleigh, N.C. 27640-0520

CD-419

Web

3-03

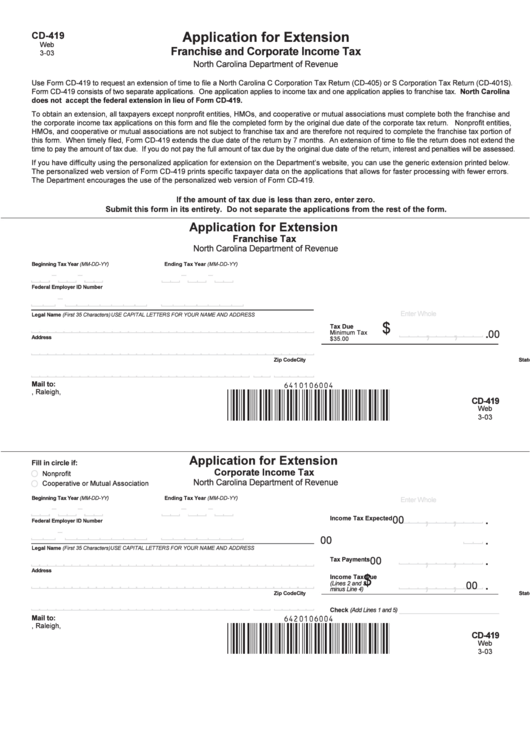

Application for Extension

Fill in circle if:

Corporate Income Tax

Nonprofit

North Carolina Department of Revenue

Cooperative or Mutual Association

Beginning Tax Year (MM-DD-YY)

Ending Tax Year (MM-DD-YY)

Enter Whole U.S. Dollars Only

,

,

2. Total Corporate

.

00

Income Tax Expected

Federal Employer ID Number

N.C. Secretary of State ID Number

.

3. Annual Report Fee

00

Legal Name (First 35 Characters) USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

,

,

4. Estimated Income

.

00

Tax Payments

5. Total Corporate

Address

,

,

$

Income Tax Due

.

(Lines 2 and 3

00

minus Line 4)

City

State

Zip Code

6. Amount of Enclosed

Check (Add Lines 1 and 5)

Mail to: N.C. Department of Revenue

P.O. Box 25000, Raleigh, N.C. 27640-0520

CD-419

Web

3-03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1