Instructions For Extensions Of Time For Filing Returns - Georgia Income Tax Division

ADVERTISEMENT

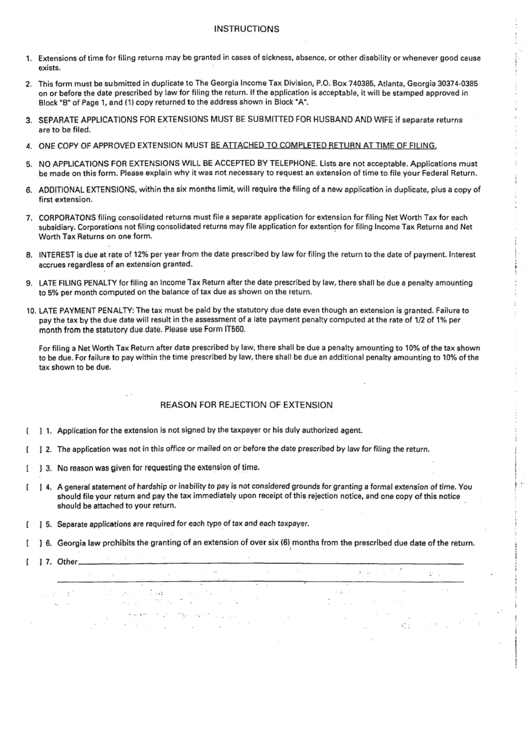

INSTRUCTIONS

1.

2.

3.

4.

5.

6.

7.

8.

9.

Extensions o ftimeforfilingreturnsmaybegrantedincasesofsickness, a bsence, o r otherdisability o rwhenever goodcause

~

exists.

Thisformmustbesubmitted induplicate to TheGeorgia Income TaxDivision, P.O.Box740385, Atlanta, G eorgia 30374-0385

onor beforethedateprescribed bylawforfiling the return.Iftheapplication i sacceptable, itwillbestampedapprovedin

Block “B” ofPage1,and(1)COPY r eturnedto theaddressshownin Block “A.

SEPARATE APPLICATIONS

FOREXTENSIONS MUST BESUBMITTED FORHUSBAND A ND WIFE ifseparatereturns

are to be filed.

ONECOPY OFAPPROVED EXTENSION M UST BEAnACHED TOCOMPLETED

RETURN A TTIME OFFILING.

NOAPPLICATIONS

FOREXTENSIONS WILL BEACCEPTED BY TELEPHONE. Listsare notacceptable. A pplications m ust

be madeonthisform.Pleaseexplainwhyitwas notnecessary to requestan extensionoftimeto fileyourFederalReturn.

ADDITIONAL

EXTENSIONS,

withinthe sixmonthslimit, w illrequirethefilingofa newapplication i nduplicate, p lusa copyof

firstextension.

CORPORATONS

filing consolidated returnsmustfilea separateapplication f orextension forfilingNetWorthTaxforeach

subsidiary. Corporations notfiling consolidated r eturns mayfileapplication f orextention f orfiling Income TaxReturns a ndNet

WorthTaxReturns on oneform.

INTEREST isdueat rateof 12%peryearfromthedateprescribed by lawforfiling thereturnto the dateofpayment. I nterest

accruesregardless ofan extension granted.

LATE F ILING P ENALTY

forfiling anIncome TaxReturn afterthedateprescribed b ylaw, t hereshallbeduea penalty amounting

to 5%permonthcomputed onthe balanceoftaxdueas shownonthe return.

IO.LATE PAYMENT PENALTY:

Thetax mustbe paidbythestatutoryduedateeventhoughan extension is granted. F ailure to

paythetaxbytheduedatewillresultinthe assessment o fa latepayment p enalty computed at the rateof 1/2of 1%. p er

monthfromthestatutoryduedate.PleaseuseFormIT560.

Forfiling a NetWorth TaxReturn afterdateprescribed bylaw,thereshallbeduea penalty amounting to 10% ofthetaxshown

to bedue.Forfailure to paywithin thetimeprescribed bylaw,thereshallbedueanadditional penalty amounting t o 10% ofthe

taxshownto bedue.

REASONFORREJECTION OF EXTENSION

[ 11.

[ 12.

[ 13.

[ 14.

[ 15.

[ 16.

[ 17.

Application fortheextension is notsignedbythetaxpayer o r hisdulyauthorized a gent.

Theapplication w asnotinthisoffice or mailed onor beforethedateprescribed bylawforfiling thereturn.

Noreasonwasgivenforrequesting theextension oftime.

Ageneral s tatement o fhardship or inability t o payisnotconsidered g rounds forgranting a formal e xtension oftime.You

shouldfileyourreturnandpaythetaximmediately u ponreceipt o fthisrejection notice, a ndonecopyofthisnotice

shouldbeattached to yourreturn.

Separate applications arerequired foreachtypeoftaxandeachtaxpayer.

Georgia law prohibits the granting of an extension of over six (6),months from the prescribed due date of the return.

Other

.

.

-.

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1