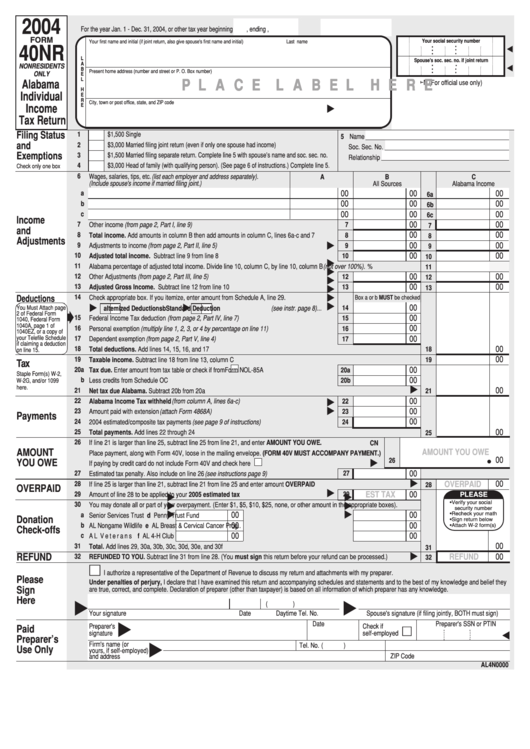

Form 40nr - Alabama Individual Income Tax Return - 2004

ADVERTISEMENT

2004

For the year Jan. 1 - Dec. 31, 2004, or other tax year beginning

, ending

,

FORM

Your social security number

Your first name and initial (if joint return, also give spouse's first name and initial)

Last name

. .

. .

40NR

.

.

L

Spouse's soc. sec. no. if joint return

. .

. .

A

NONRESIDENTS

.

.

B

Present home address (number and street or P. O. Box number)

ONLY

E

L

P P L L A A C C E E L L A A B B E E L L H H E E R R E E

Alabama

FN (For official use only)

H

Individual

E

R

City, town or post office, state, and ZIP code

E

Income

Tax Return

Filing Status

1

$1,500 Single

5 Name

and

2

$3,000 Married filing joint return (even if only one spouse had income)

Soc. Sec. No.

Exemptions

3

$1,500 Married filing separate return. Complete line 5 with spouse’s name and soc. sec. no.

Relationship

4

$3,000 Head of family (with qualifying person). (See page 6 of instructions.) Complete line 5.

Check only one box

6

Wages, salaries, tips, etc. (list each employer and address separately).

A

B

C

(Include spouse's income if married filing joint.)

Ala.Tax Withheld

All Sources

Alabama Income

00

00

00

a

6a

00

00

00

b

6b

00

00

00

c

6c

Income

7

00

00

Other income (from page 2, Part I, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

and

00

00

8

Total income. Add amounts in column B then add amounts in column C, lines 6a-c and 7 . . . . . . . .

8

8

Adjustments

00

00

9

Adjustments to income (from page 2, Part II, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

00

00

10

Adjusted total income. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10

11

Alabama percentage of adjusted total income. Divide line 10, column C, by line 10, column B (not over 100%). . . . . . . . . . . . . . . . . . . . .

%

11

12

00

00

Other Adjustments (from page 2, Part III, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12

00

00

13

Adjusted Gross Income. Subtract line 12 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

14

Deductions

Check appropriate box. If you itemize, enter amount from Schedule A, line 29.

Box a or b MUST be checked

00

You Must Attach page

14

a

Itemized Deductions

b

Standard Deduction (see instr. page 8) . . .

2 of Federal Form

00

15

Federal Income Tax deduction (from page 2, Part IV, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

1040, Federal Form

1040A, page 1 of

16

00

Personal exemption (multiply line 1, 2, 3, or 4 by percentage on line 11) . . . . . . . . . . . . . . . . . . . . . .

16

1040EZ, or a copy of

your Telefile Schedule

00

17

Dependent exemption (from page 2, Part V, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

if claiming a deduction

00

18

Total deductions. Add lines 14, 15, 16, and 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

on line 15.

00

19

Taxable income. Subtract line 18 from line 13, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

Tax

00

20a

Tax due. Enter amount from tax table or check if from

Form NOL-85A . . . . . . . . . . . . . . . . . .

20a

Staple Form(s) W-2,

b

00

Less credits from Schedule OC. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20b

W-2G, and/or 1099

here.

00

21

Net tax due Alabama. Subtract 20b from 20a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22

Alabama Income Tax withheld (from column A, lines 6a-c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23

Amount paid with extension (attach Form 4868A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

Payments

00

24

2004 estimated/composite tax payments (see page 9 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

00

Total payments. Add lines 22 through 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26

If line 21 is larger than line 25, subtract line 25 from line 21, and enter AMOUNT YOU OWE.

CN

.

AMOUNT

AMOUNT YOU OWE

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.)

00

26

YOU OWE

If paying by credit card do not include Form 40V and check here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

27

27

Estimated tax penalty. Also include on line 26 (see instructions page 9) .. . . . . . . . . . . . . . . . . . . . . . . . . .

28

OVERPAID

00

If line 25 is larger than line 21, subtract line 21 from line 25 and enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

OVERPAID

00

29

29

EST TAX

Amount of line 28 to be applied to your 2005 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PLEASE

• Verify your social

30

You may donate all or part of your overpayment. (Enter $1, $5, $10, $25, none, or other amount in the appropriate boxes).

security number

00

00

• Recheck your math

a

Senior Services Trust Fund . . .

d Penny Trust Fund. . . . . . . . . . . . . . . .

Donation

• Sign return below

00

00

b

AL Nongame Wildlife Fund . . .

e AL Breast & Cervical Cancer Prog. .

• Attach W-2 form(s)

Check-offs

c

00

00

AL Veterans Program . . . . . . . .

f AL 4-H Club . . . . . . . . . . . . . . . . . . . . .

00

31

Total. Add lines 29, 30a, 30b, 30c, 30d, 30e, and 30f . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

REFUND

32

REFUND

00

REFUNDED TO YOU. Subtract line 31 from line 28. (You must sign this return before your refund can be processed.) . . . . . . . .

32

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they

Sign

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

(

)

Your signature

Date

Daytime Tel. No.

Spouse's signature (if filing jointly, BOTH must sign)

Date

Preparer's SSN or PTIN

Preparer's

Check if

Paid

signature

self-employed

Preparer’s

Firm's name (or

Tel. No.

(

)

E.I. No.

Use Only

yours, if self-employed)

and address

ZIP Code

AL4N0000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2