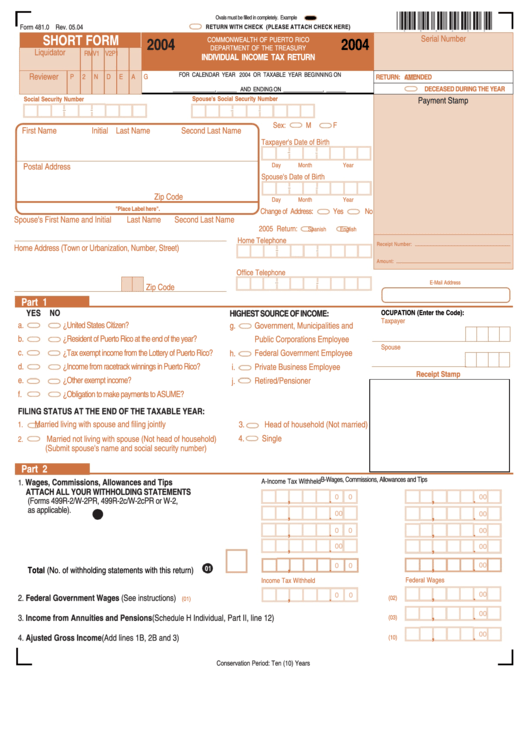

Form 481.0 - Individual Income Tax Return - 2004

ADVERTISEMENT

Ovals must be filled in completely. Example

Form 481.0 Rev. 05.04

RETURN WITH CHECK (PLEASE ATTACH CHECK HERE)

SHORT FORM

Serial Number

2004

COMMONWEALTH OF PUERTO RICO

2004

DEPARTMENT OF THE TREASURY

Liquidator

R

M V1 V2 P1

INDIVIDUAL INCOME TAX RETURN

Reviewer

FOR CALENDAR YEAR 2004 OR TAXABLE YEAR BEGINNING ON

P2 N

D

E

A

G

RETURN:

AMENDED

DECEASED DURING THE YEAR

_______________, _______ AND ENDING ON ______________, _______

Social Security Number

Spouse's Social Security Number

Payment Stamp

Sex:

M

F

First Name

Initial

Last Name

Second Last Name

Taxpayer's Date of Birth

Postal Address

Day

Month

Year

Spouse's Date of Birth

Zip Code

Day

Month

Year

"Place Label here".

Change of Address:

Yes

No

Spouse's First Name and Initial

Last Name

Second Last Name

2005 Return:

Spanish

English

Home Telephone

Receipt Number:

Home Address (Town or Urbanization, Number, Street)

Amount:

Office Telephone

E-Mail Address

Zip Code

Part 1

NO

YES

HIGHEST SOURCE OF INCOME:

OCUPATION (Enter the Code):

Taxpayer

a.

¿United States Citizen?

g.

Government, Municipalities and

b.

¿Resident of Puerto Rico at the end of the year?

Public Corporations Employee

Spouse

c.

¿Tax exempt income from the Lottery of Puerto Rico?

Federal Government Employee

h.

d.

¿Income from racetrack winnings in Puerto Rico?

Private Business Employee

i.

Receipt Stamp

e.

¿Other exempt income?

Retired/Pensioner

j.

f.

¿Obligation to make payments to ASUME?

FILING STATUS AT THE END OF THE TAXABLE YEAR:

3.

Head of household (Not married)

Married living with spouse and filing jointly

1.

4.

Single

Married not living with spouse (Not head of household)

2.

(Submit spouse's name and social security number)

Part 2

B-Wages, Commissions, Allowances and Tips

Wages, Commissions, Allowances and Tips

A-Income Tax Withheld

1.

ATTACH ALL YOUR WITHHOLDING STATEMENTS

.

0

0

.

0

0

,

,

(Forms 499R-2/W-2PR, 499R-2c/W-2cPR or W-2,

as applicable).

00

.

0

0

.

0

0

,

,

.

0

0

.

0

0

,

,

.

0

0

.

0

0

,

,

.

.

0

0

0

0

,

,

01

Total (No. of withholding statements with this return) ............

Federal Wages

Income Tax Withheld

.

0

0

.

0

0

2. Federal Government Wages (See instructions) ..................................

,

,

(02)

(01)

.

0

0

,

3. Income from Annuities and Pensions (Schedule H Individual, Part II, line 12) ....................................................

(03)

.

0

0

4. Ajusted Gross Income (Add lines 1B, 2B and 3) ..................................................................................................

,

(10)

Conservation Period: Ten (10) Years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3