Print

Reset

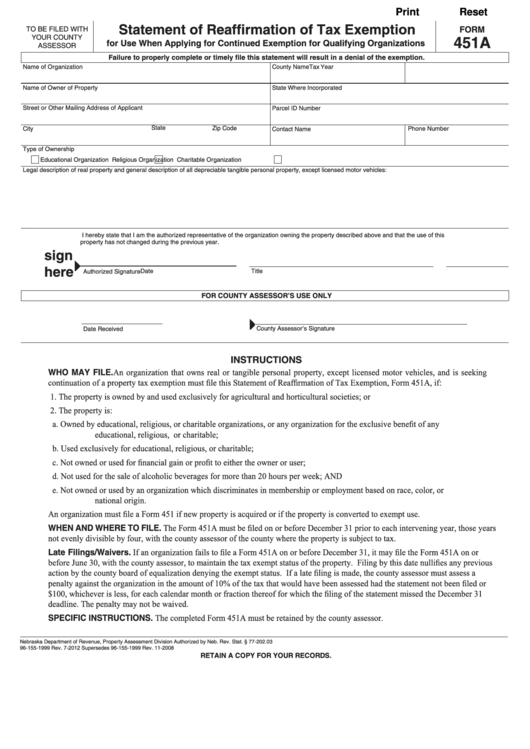

Statement of Reaffirmation of Tax Exemption

FORM

TO BE FILED WITH

451A

YOUR COUNTY

for Use When Applying for Continued Exemption for Qualifying Organizations

ASSESSOR

Failure to properly complete or timely file this statement will result in a denial of the exemption.

Name of Organization

County Name

Tax Year

Name of Owner of Property

State Where Incorporated

Street or Other Mailing Address of Applicant

Parcel ID Number

State

City

Zip Code

Phone Number

Contact Name

Type of Ownership

Educational Organization

Religious Organization

Charitable Organization

Legal description of real property and general description of all depreciable tangible personal property, except licensed motor vehicles:

I hereby state that I am the authorized representative of the organization owning the property described above and that the use of this

property has not changed during the previous year.

sign

here

Title

Date

Authorized Signature

FOR COUNTY ASSESSOR’S USE ONLY

County Assessor’s Signature

Date Received

INSTRUCTIONS

WHO MAY FILE. An organization that owns real or tangible personal property, except licensed motor vehicles, and is seeking

continuation of a property tax exemption must file this Statement of Reaffirmation of Tax Exemption, Form 451A, if:

1.

The property is owned by and used exclusively for agricultural and horticultural societies; or

2.

The property is:

a.

Owned by educational, religious, or charitable organizations, or any organization for the exclusive benefit of any

educational, religious, or charitable;

b.

Used exclusively for educational, religious, or charitable;

c.

Not owned or used for financial gain or profit to either the owner or user;

d.

Not used for the sale of alcoholic beverages for more than 20 hours per week; AND

e.

Not owned or used by an organization which discriminates in membership or employment based on race, color, or

national origin.

An organization must file a Form 451 if new property is acquired or if the property is converted to exempt use.

WHEN AND WHERE TO FILE. The Form 451A must be filed on or before December 31 prior to each intervening year, those years

not evenly divisible by four, with the county assessor of the county where the property is subject to tax.

Late Filings/Waivers. If an organization fails to file a Form 451A on or before December 31, it may file the Form 451A on or

before June 30, with the county assessor, to maintain the tax exempt status of the property. Filing by this date nullifies any previous

action by the county board of equalization denying the exempt status. If a late filing is made, the county assessor must assess a

penalty against the organization in the amount of 10% of the tax that would have been assessed had the statement not been filed or

$100, whichever is less, for each calendar month or fraction thereof for which the filing of the statement missed the December 31

deadline. The penalty may not be waived.

SPECIFIC INSTRUCTIONS. The completed Form 451A must be retained by the county assessor.

Nebraska Department of Revenue, Property Assessment Division

Authorized by Neb. Rev. Stat. § 77-202.03

96-155-1999 Rev. 7-2012 Supersedes 96-155-1999 Rev. 11-2008

RETAIN A COPY FOR YOUR RECORDS.

1

1