Real Estate Tax Relief For Elderly And/or Totally Disabled Persons Application - City Of Alexandria - 2005 Page 2

ADVERTISEMENT

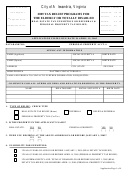

INCOME INFORMATION (FOR 1/1/2004 – 12/31/2004)

PROOF OF ALL INCOME MUST BE PROVIDED

APPLICANT AND SPOUSE

Applicant

Spouse

1

Social Security or Railroad Retirement

2

Pension

3

Annuity

4

Interest and Dividends (To include State and Municipal Bonds)

5

Salary, Bonus and Commissions

6

IRA Distributions

7

Rental Income (Net)

8

Alimony/Child Support

9

Other Income (Sick Pay, Disability Payments, Gifts, etc.)

10 Total Gross Income For Each Person

$

$

11 Total Gross Income for Applicant & Spouse

$

ALL OTHER OWNERS AND RELATIVES RESIDING IN THE PROPERTY

Other Owner

Other Owner

/Relative 1

/Relative 2

12 Social Security or Railroad Retirement

13 Pension

14 Annuity

15 Interest and Dividends (To include State and Municipal Bonds)

16 Salary, Bonus and Commissions

17 IRA Distributions

18 Rental Income (Net)

19 Alimony/Child Support

20 Other Income (Sick Pay, Disability Payments, Gifts, etc.)

21 Total Gross Income For Each Person

$

$

22 Total Gross Income for Relative(s), Other Owner(s)

$

OFFICIAL USE ONLY

Total Income for Personal Property Tax Relief (Line 11)

$

Total Gross Income for Real Estate Tax Relief (Line 11 + Line 22)

$

Less Disability Exclusion

Less Income Exclusion (for Other Relative)

Total Net Income for Real Estate Tax Relief

$

Application Page 2 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4