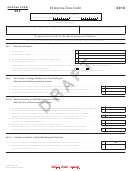

Arizona Form 304 Draft - Enterprise Zone Credit - 2010 Page 2

ADVERTISEMENT

Name:

TIN:

AZ Form 304 (2010)

Page 2 of 3

Part V

Credit Calculation for Qualifi ed Employment Positions

14 Arizona residency. Are all of the employees in qualifi ed employment positions Arizona residents?

See instructions before answering this question.

Yes

No

If the answer to this question is no, the business is not eligible for an enterprise zone credit for those qualifi ed

employment positions fi lled by employees who are not Arizona residents.

(a)

(b)

(c)

(d)

Number of qualifi ed

employment positions

Qualifying wages

%

Allowable credit

Employees in fi rst year or

15

25%

partial year of employment in

a qualifi ed employment position

Employees in the second year

16

33 1/3%

of continuous employment in

a qualifi ed employment position

Employees in the third year

17

50%

of continuous employment in

a qualifi ed employment position

18

Totals

Part VI Limited Liability Companies

19 What is the federal tax classifi cation of the limited liability company (LLC)? Check only one box.

S corporation

partnership

disregarded entity

corporation

If the LLC is an S corporation, complete Part VII.

If the LLC is a partnership, complete Part VIII.

Part VII S Corporation Credit Election and Shareholder’s Share of Credit

20 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

MM

MM

DD

DD

YYYY

YYYY

(CHECK ONLY ONE BOX)

Claim the enterprise zone credit as shown on Part V, line 18, column (d) (for the taxable year mentioned above);

OR

Pass the enterprise zone credit as shown on Part V, line 18, column (d) (for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 21 through 23 separately for each shareholder.

Furnish each shareholder with a copy of the completed Form 304.

21 Name of shareholder

22 Shareholder’s TIN

23 Shareholder’s share of the amount on Part V, line 18, column (d) .................................................................................................

23

00

ADOR 10130 (10)

DRAFT 10/5/09, 11:45 a.m.

DRAFT 10/5/09, 11:45 a.m.

Previous ADOR 91-0050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5