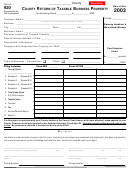

Machinery and Equipment -- Schedule 2. List at 25% machinery, repair parts, small tools, etc., used in manufacturing, mining, laundries,

dry cleaning, towel and linen supply, stone and gravel plants and radio and television broadcasting. If the value of equipment is based on

other than book value, attach detail of computation.

Taxing District

Description

True Value

Listed Value

$

$

Total

(Carry Listed Value by Taxing District to Line 2 on Front of Return)

$

$

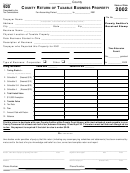

Inventories -- Schedules 3 and 3A. Monthly inventory values are required of merchants and manufacturers. Inventory of finished products

of a manufacturer not kept or stored in the place of manufacture or in a warehouse in the county where manufactured, shall be listed as

merchandising inventory.

Complete Information Below:

Method of Valuing Inventories Listed

Source of Values Listed

Perpetual Inventory

____________________ FIFO Cost

____________________ Retail

____________________ LIFO Cost

____________________ Other

Physical Inventory

Book Adjustments

Date

Amount

DR/CR

Gross Profits method

Dates physicals taken:

Book to Physical

LIFO Reserve

Net Sales

$

Other Reserves

Schedule 3

Schedule 3A

Merchandising Inventories

Manufacturing Inventories

Taxing District Taxing District Taxing District

Taxing District Taxing District

Months in Business

Book Value

Book Value

Book Value

Book Value

Book Value

January

$

$

$

$

$

February

March

April

May

June

July

August

September

October

November

December

$

$

$

$

$

Total Values

Average Values

$

$

$

$

$

Divide by No. of Months

List at 25% of

$

$

$

$

$

Average Value

(Carry Listed Value by Taxing District to Line 3 or 4 on Front of Return)

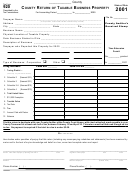

Schedule 4 -- Furniture, Fixtures, Machinery and Equipment and Supplies Not Used in Manufacturing. List at 25% furniture, fixtures, machinery and

equipment, supplies, small tools and repair parts not used in manufacturing, inventories of other than a manufacturer or merchant and all domestic

animals not used in agriculture. List property used by public utility companies, and other property used in generating and distributing electricity to

others at the listing percentage for that type of property. Contact the Propety Tax Division for instructions. If the value is based on other than book

value, attach details of the computation.

Taxing District

Description

True Value Per Cent

Listed Value

$

$

Total (Carry Listed Value by Taxing District to Line 5 on Front of Return)

$

$

1

1 2

2