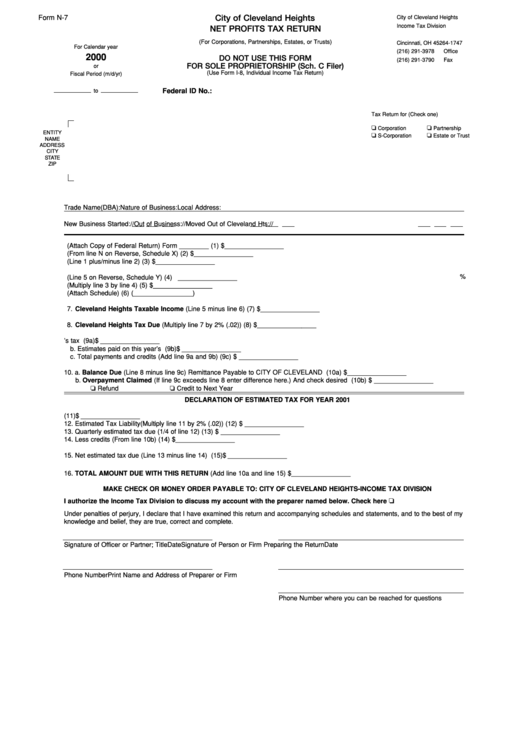

Form N-7 - Net Profits Tax Return - 2000

ADVERTISEMENT

City of Cleveland Heights

Form N-7

City of Cleveland Heights

Income Tax Division

NET PROFITS TAX RETURN

P.O. Box 641747

(For Corporations, Partnerships, Estates, or Trusts)

Cincinnati, OH 45264-1747

For Calendar year

(216) 291-3978

Office

2000

DO NOT USE THIS FORM

(216) 291-3790

Fax

FOR SOLE PROPRIETORSHIP (Sch. C Filer)

or

(Use Form I-8, Individual Income Tax Return)

Fiscal Period (m/d/yr)

Federal ID No.:

to

Tax Return for (Check one)

❏

❏

Corporation

Partnership

ENTITY

❏

❏

S-Corporation

Estate or Trust

NAME

ADDRESS

CITY

STATE

ZIP

Trade Name(DBA):

Nature of Business:

Local Address:

New Business Started:

/

/

Out of Business:

/

/

Moved Out of Cleveland Hts:

/

/

1. Total Taxable Income (Attach Copy of Federal Return) Form ________ ...........................................................(1) $ ________________

2. Adjustments (From line N on Reverse, Schedule X)..........................................................................................(2) $ ________________

3. Taxable Income before allocation (Line 1 plus/minus line 2)..............................................................................(3) $ ________________

%

4. Allocation Percentage (Line 5 on Reverse, Schedule Y) ...................................................................................(4)

________________

5. Adjusted Net Income (Multiply line 3 by line 4) ..................................................................................................(5) $ ________________

6. Less Allocable Net Loss per Previous Cleveland Heights Tax Return (Attach Schedule) .................................(6) ( ________________)

7. Cleveland Heights Taxable Income (Line 5 minus line 6)...............................................................................(7) $ ________________

8. Cleveland Heights Tax Due (Multiply line 7 by 2% (.02)).................................................................................(8) $ ________________

9.a. Credits applied from previous year’s tax return ..............................................................................................(9a) $ ________________

b. Estimates paid on this year’s liability ..............................................................................................................(9b) $ ________________

c. Total payments and credits (Add line 9a and 9b) ............................................................................................(9c) $ ________________

10. a. Balance Due (Line 8 minus line 9c) Remittance Payable to CITY OF CLEVELAND HEIGHTS ..............(10a) $ ________________

b. Overpayment Claimed (If line 9c exceeds line 8 enter difference here.) And check desired block.........(10b) $ ________________

❏ Refund

❏ Credit to Next Year

DECLARATION OF ESTIMATED TAX FOR YEAR 2001

11. Total estimated income subject to tax ..............................................................................................................(11) $ ________________

12. Estimated Tax Liability(Multiply line 11 by 2% (.02)) ........................................................................................(12) $ ________________

13. Quarterly estimated tax due (1/4 of line 12).....................................................................................................(13) $ ________________

14. Less credits (From line 10b).............................................................................................................................(14) $ ________________

15. Net estimated tax due (Line 13 minus line 14) ...............................................................................................(15) $ ________________

16. TOTAL AMOUNT DUE WITH THIS RETURN (Add line 10a and line 15) ..............................................................$ ________________

MAKE CHECK OR MONEY ORDER PAYABLE TO: CITY OF CLEVELAND HEIGHTS-INCOME TAX DIVISION

❏

I authorize the Income Tax Division to discuss my account with the preparer named below. Check here

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my

knowledge and belief, they are true, correct and complete.

Signature of Officer or Partner; Title

Date

Signature of Person or Firm Preparing the Return

Date

Phone Number

Print Name and Address of Preparer or Firm

Phone Number where you can be reached for questions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2