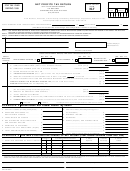

Form N-7 - Net Profits Tax Return - 2000 Page 2

ADVERTISEMENT

SCHEDULE X-RECONCILIATION WITH FEDERAL INCOME TAX RETURN

Items Not Deductible

Add

Items Not Taxable

Deduct

A. Capital Losses .............................................................$ ________________

I. Capital Gains.............................. __________________

B. Income Taxes Paid or Accrued..................................... ________________

J. Interest Income.......................... __________________

C. Contributions ................................................................ ________________

K. Dividends .................................. __________________

D. Net operating loss deductions per Federal Return ...... ________________

L. Other Income Exempt (explain) __________________

E. Guaranteed payments to partners................................ ________________

....................................................... __________________

F. Expenses attributable to non-taxable income ............... ________________

....................................................... __________________

(See Instructions)

....................................................... __________________

G. Other ............................................................................ ________________

....................................................... __________________

________________

H. Total Additions .............................................................$ ________________

M. Total Deductions....................... __________________

N. Combine lines H and M and enter net on line 2 ______________________

SCHEDULE Y-BUSINESS ALLOCATION FORMULA

a. Located Everywhere

b. Located in Cleveland Heights

c. Percentage (b/a)

STEP 1. Average Value of Real & Tangible Personal Property . . _______________

______________________

____________

Gross Amount Rentals Paid Multiplied by 8 . . . . . . . _______________

______________________

____________

TOTAL STEP 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

______________________

____________%

STEP 2. Gross Receipts from Sales Made and/or

Work Or Services Performed . . . . . . . . . . . . . . . . . . _______________

______________________

____________%

STEP 3. Wages, Salaries, Etc. Paid . . . . . . . . . . . . . . . . . . . . _______________

______________________

____________%

4. Total Percentages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

____________%

5. Average Percentage (Divide Total Percentage by Number of Percentages used-enter on line 4) . . . . . . . . . . . . . . . . . ____________%

SCHEDULE Z-PARTNER’S DISTRIBUTIVE SHARES OF NET INCOME

(From Federal Schedule 1065 K-1s and 1099)

1. Name and Address of Each Partner

Resident

Distributive Shares of Partner

Other Payments

Taxable

Amount Taxable

Y/N

Percentage

Percent

Amount

%

a.

%

$

$

$

%

b.

$

$

$

%

%

c.

$

$

$

%

%

$

d.

$

$

%

$

100 %

$

$

2. TOTALS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2