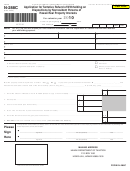

FORM N-288B

(REV. 2016)

5a. Calculation and written justification showing that the transferor/seller will not realize any gain with respect to the transfer.

Attach a copy of a tentative statement from your escrow company for this transaction showing the gross sales price.

Also attach a copy of your closing escrow statement from your purchase or acquisition of this property. (Note: You must

provide documentation for all items in the calculation.)

1.

Sales Price

$ __________________________

Attach a schedule or list below

2.

Cost or other basis (including selling expenses).

to indicate the breakdown of your calculations.

(If you checked “Yes” on line 6, page 1, or used the property for business

purposes, provide your adjusted basis for the property, i.e., cost less

depreciation. Also, attach a copy of your depreciation schedule, regardless

of whether or not you have taken any depreciation.) Do not include any

carryforward losses or net operating losses.

__________________________

3.

Line 1 minus line 2. (If greater than zero, was the property used as your main

home and do you qualify to exclude the entire gain? If yes, use Form N-103 as

a worksheet and attach to Form N-288B. Otherwise, you DO NOT qualify for

a waiver of the withholding. Do not file this form with the State of Hawaii,

Department of Taxation.)

$ __________________________

5b. Calculation and written justification showing that there will be insufficient proceeds to pay the withholding required under

section 235-68(b), Hawaii Revised Statutes, after payment of all costs, including selling expenses and the amount of

any mortgage or lien secured by the property. Attach a copy of a tentative statement from your escrow company for this

transaction showing the distribution of funds received.

1a. Sales price

$ __________________________

1b. Sales proceeds to be received in forms

other than cash (describe) __________________________________

___________________________

1c. Sales proceeds to be received in cash (Line 1a minus line 1b)

___________________________

Attach a schedule

2a. Selling expenses.

or list below to indicate the breakdown of

your calculations.

$ ________________________

2b. Mortgage(s) secured by the property sold to

be paid off with cash proceeds

________________________

2c. Other (list):

3.

Add lines 2a through 2c

__________________________

4.

Amount to be withheld. Line 1c minus line 3 (If less than zero, enter zero)

$ __________________________

1

1 2

2 3

3