Instructions For Maryland Resident Income Tax Returns Forms 502 And 503 - 2002

ADVERTISEMENT

1 IMPORTANT NOTES 1

SUBSTlTUTE

provided

TODElERMlNElFYOUAREREQUlREDTO

if~ayourq1nuseis65crcruer,useTable2

YouarearesidentofMarylandifz

tlekxv.

IFYOU ARE NOT REQUIREDTO FlLE

AMARYLANDRElURNBUTHAD

irKomeisdsfinedintheIntemalRevenueCcde

and,ingeneml,ccnsis&ofalincomeregar&

MARYLANDTAXESWRHHELD

der&lfromd&ngsinproperh/,interesfrents,

shouldcompletealloftheinfwmationatthetop

ofFonn502orForm503andcompletethefol-

~iKxKnefrom~porfiduciaries,

~wliyom.2

PARWEAR

etclfmodificationsordedudicnsreduceyour

gmesincomebebwtheminimumfilinglevsl,

1,7, 10

you are still requimd to file. IRS PuNii 525

25,32

46,48

MlLllARY

metltbetie&inyWrtotaifederalincome.

c.

~dd~~totalfederalj,o,meanyMaryland

maybeaMetouseForm123togetyourrefund

w dad b v of md&nce. b

k&udion 12. This is ywr Maryland gmss

dence.

withMing you are daiming.

goB envetoPe from the tax Packet You must file

I- 12 and 13. This is your Mar$and

qossinaxne.

receiveanYrefund.

grcssincomeequaisorexceedstheincome

le&sinTablel

beloJv.

@ Recycled Paper

MARYLAND RESIDENT

INSTRUCTIONS

INCOME TAX RETURNS

2 0 0 2

FORMS 502 and 503

enue Administration Division. The fact that a

be rounded to the next higher dollar. State

calculations are rounded to the nearest software package is available for retail pur-

penny.

chase does not guarantee that it has been

approved fOr use.

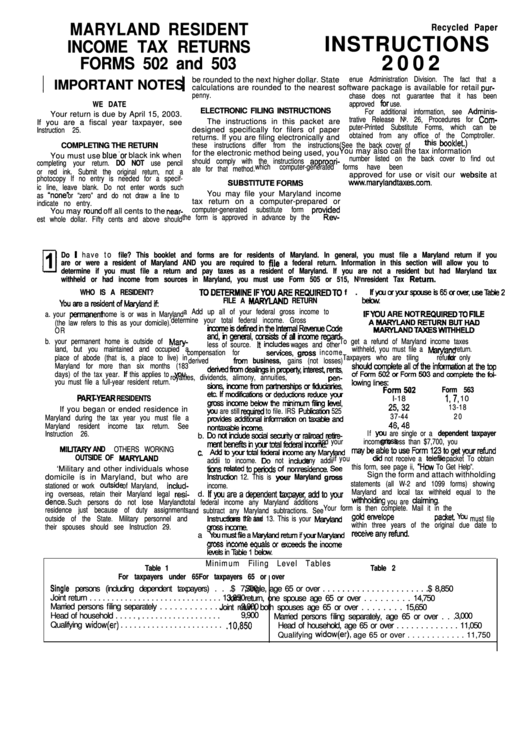

WE DATE

ELECTRONIC FILING INSTRUCTIONS

For additional information, see Adminis-

Your return is due by April 15, 2003.

trative Release No. 26, Procedures for Com-

The instructions in this packet are

If you are a fiscal year taxpayer, see

puter-Printed Substitute Forms, which can be

designed specifically for filers of paper

Instruction 25.

obtained from any office of the Comptroller.

returns. If you are filing electronically and

these instructions differ from the instructions

(See the back cover of this booklet.)

COMPLETING THE RETURN

You may also call the tax information

for the electronic method being used, you

You must use blue’or

black ink when

number listed on the back cover to find out

should comply with the instructions appropri-

completing your return. DO NOT use pencil

which

computer-generated

forms

have

been

ate for that method.

or red ink. Submit the original return, not a

approved for use or visit our website

at

photocopy If no entry is needed for a specif-

FORMS

ic line, leave blank. Do not enter words such

You may file your Maryland income

as “nonel

or “zero” and do not draw a line to

tax return on a computer-prepared or

indicate no entry.

computer-generated

substitute

form

You may round off all cents to the near-

the form is approved in advance by the Rev-

est whole dollar. Fifty cents and above should

to

Do I have

file? This booklet and forms are for residents of Maryland. In general, you must file a Maryland return if you

are or were a resident of Maryland AND you are required to file a federal return. Information in this section will allow you to

determine if you must file a return and pay taxes as a resident of Maryland. If you are not a resident but had Maryland tax

withheld or had income from sources in Maryland, you must use Form 505 or 515, Nonresident Tax Return.

WHO IS A RESIDENT?

f

.

FILE A MARYlAND RETURN

a Add up all of your federal gross income to

a. your permanent home is or was in Maryland

determine your total federal income. Gross

(the law refers to this as your domicile).

O R

b. your permanent home is outside of Mary-

To get a refund of Maryland income taxes

less of source. lt indudes

wages and other

land, but you maintained and occupied a

withheld, you must file a Marytand return.

compensation for servkes, gloss income

place of abode (that is, a place to live) in

Taxpayers who are tiling for refund only

derived from business, gains (not losses)

Maryland for more than six months (183

days) of the tax year. lf this applies to you,

royalties, dividends, alimony, annuities, pen-

you must file a full-year resident return.

Form 563

RESIDENTS

I-18

13-18

If you began or ended residence in

37-44

2 0

Maryland during the tax year you must file a

Maryland

resident

income

tax

return.

See

If pu are single or a dependent taxpayer

Instruction 26.

b. DoIldindudesocial~orrailroadreilre-

and your grcss income is less than $7,700, you

AND OTHERS WORKING

OUTSIDE OF MARYlAND

if you did not receive a telefile packet To obtain

addii to income. Do not indude any addii

this form, see page ii, ‘Hw To Get Help”.

‘Military and other individuals whose

Sign the form and attach withholding

domicile is in Maryland, but who are

statements (all W-2 and 1099 forms) showing

stationed or work outside of Maryland, includ-

income.

Maryland and local tax withheld equal to the

ing overseas, retain their Maryland legal resi-

d. lfyouareadependenttaxpqecaddtoyour

Such persons do not lose Maryland

total federal income any Maryland additions

Your form is then complete. Mail it in the

residence just because of duty assignments

and subtract any Maryland subtractions. See

outside of the State. Military personnel and

within three years of the original due date to

their spouses should see Instruction 29.

a YoumustfileaMaqlandmtumifyourMa@and

Minimum Filing Level Tables

Table 1

Table 2

For taxpayers under 65

For taxpayers 65 or over

Single

persons (including dependent taxpayers) . . .$ 7,700

Single, age 65 or over . . . . . . . . . . . . . . . . . . . . . .$ 8,850

Joint return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,850

Joint return, one spouse age 65 or over . . . . . . . . . 14,750

Married persons filing separately . . . . . . . . . . . . . .

3,000

Joint return, both spouses age 65 or over . . . . . . . . 15,650

9,900

Head of household . . . . . , . . . . . . . . . . . . . . . . . .

3,000

Married persons filing separately, age 65 or over . . .

Qualifying widow(er) . . . . . . . . . . . . . . . . . . . . . . . .10,850

Head of household, age 65 or over . . . . . . . . . . . . . 11,050

Qualifying widow(er),

age 65 or over . . . . . . . . . . . . 11,750

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25