Instructions For Maryland Nonresident Income Tax Return Form 505 - 2002

ADVERTISEMENT

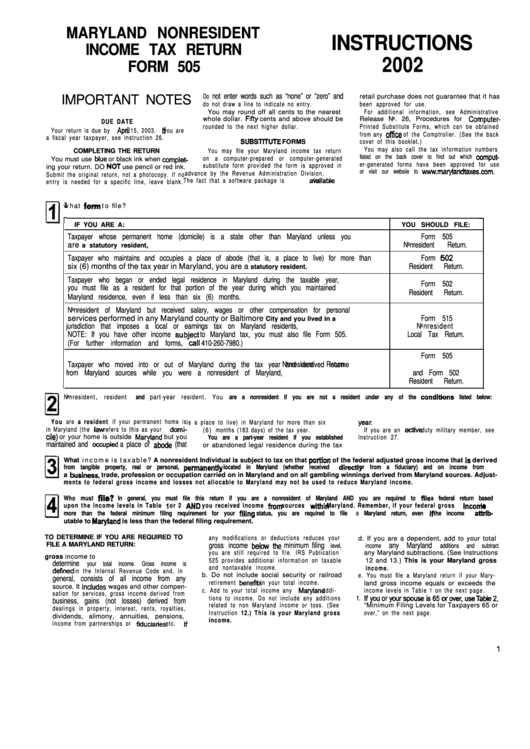

1 IMPORTANT NOTES

April 15, 2003. tf you are

SUBSTlTUTE FORMS

7

PI

year.

tile) or your home is outside Maryland

El

@I

defined

the minimum filing

1

El-

MARYLAND NONRESIDENT

INSTRUCTIONS

INCOME TAX RETURN

2002

FORM 505

not enter words such as “none” or “zero” and

Do

retail purchase does not guarantee that it has

do not draw a line to indicate no entry.

been approved for use.

You may round off all cents to the nearest

For additional information, see Administrative

whole dollar. F#ty cents and above should be

Release No. 26, Procedures for Computer-

DUE DATE

rounded to the next higher dollar.

Printed Substitute Forms, which can be obtained

Your return is due by

from any ofrice

of the Comptroller. (See the back

a fiscal year taxpayer, see Instruction 26.

cover of this booklet.)

You may also call the tax information numbers

COMPLETING THE RETURN

You may file your Maryland income tax return

listed on the back cover to find out which cornput-

on a computer-prepared or computer-generated

You must use Mue or black ink when cornpiet-

er-generated forms have been approved for use

substitute form provided the form is approved in

ing your return. DO NOT use pencil or red ink.

or visit our websiie to

advance by the Revenue Administration Division.

Submit the original return, not a photocopy. If no

The fact that a software package is availabte

for

entry is needed for a specific line, leave blank.

what form to file?

IF YOU ARE A:

YOU SHOULD FILE:

Taxpayer whose permanent home (domicile) is a state other than Maryland unless you

Form 505

are

Nonresident

Return.

a statutory resident,

Taxpayer who maintains and occupies a place of abode (that is, a place to live) for more than

Form 502

six (6) months of the tax year in Maryland, you are a

Resident

Return.

statutory resident.

Taxpayer who began or ended legal residence in Maryland during the taxable year,

Form 502

you must file as a resident for that portion of the year during which you maintained

Resident

Return.

Maryland residence, even if less than six (6) months.

Nonresident of Maryland but received salary, wages or other compensation for personal

services performed in any Maryland county or Baltimore

Form 515

City and you lived in a

jurisdiction that imposes a local or earnings tax on Maryland residents,

Nonresident

NOTE: If you have other income subject

to Maryland tax, you must also file Form 505.

Local Tax Return.

(For further information and forms, call 410-260-7980.)

Form 505

Taxpayer who moved into or out of Maryland during the tax year and received income

Nonresident

Return

from Maryland sources while you were a nonresident of Maryland,

and Form 502

Resident

Return.

Nonresident, resident and part-year resident. You are a nonresident if you are not a resident under any of the conditions listed below:

You are a resident if your permanent home is

is a place to live) in Maryland for more than six

(6) months (183 days) of the tax year.

in Maryland (the taw refers to this as your domii

If you are an acttve

duty military member, see

but you

You are a part-year resident if you established

Instruction 27.

maintained and cccupiecl a place of abode (that

or abandoned legal residence during the tax

What income is taxable? A nonresident Individual is subject to tax on that portion of the federal adjusted gross income that Is derived

from tangible property, real or personal, permanent@

located in Maryland (whether received directly

or from a fiduciary) and on income from

a business,

trade, profession or occupation carried on in Maryland and on all gambling winnings derived from Maryland sources. Adjust-

ments to federal gross income and losses not allocable to Maryland may not be used to reduce Maryland income.

Who must Bla? In general, you must file this return if you are a nonresident of Maryland AND you are required to file

a federal return based

upon the income levels in Table 1 or 2 AND you received income from sources within Maryland. Remember, if your federal gross income

is

status, you are required to file a Maryland return, even lf the income attrib

more than the federal minimum filing requirement for your filing

utable to Maryland

is less than the federal filing requirement.

TO DETERMINE IF YOU ARE REQUIRED TO

any modifications or deductions reduces your

d. If you are a dependent, add to your total

FILE A MARYLAND RETURN:

gross income below

any Maryland

level,

income

additions

and

subtract

you are still required to file. IRS Publication

any Maryland subtractions. (See Instructions

a.Add up all of your federal gross income to

525 provides additional information on taxable

12 and 13.) This is your Maryland gross

determine

your total income. Gross income is

and nontaxable income.

income.

in the Internal Revenue Code and, in

b. Do not include social security or railroad

e. You must file a Maryland return if your Mary-

general, consists of all income from any

retirement benetits

in your total income.

land gross income equals or exceeds the

source. It indudes

wages and other compen-

c. Add to your total income any Marytand

a d d i -

income levels in Table 1 on the next page.

sation for services, gross income derived from

tions to income. Do not include any additions

f. Ifyouorywrspouseis65wover,useTaMe2,

business, gains (not losses) derived from

related to non Maryland income or toss. (See

“Minimum Filing Levels for Taxpayers 65 or

dealings in property, interest, rents, royalties,

Instruction 12.) This is your Maryland gross

over,” on the next page.

dividends, alimony, annuities, pensions,

income.

income from partnerships or fiduciaries,

etc. l f

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9