Instructions For Form Msa - Montana Medical Care Savings Account Worksheet

ADVERTISEMENT

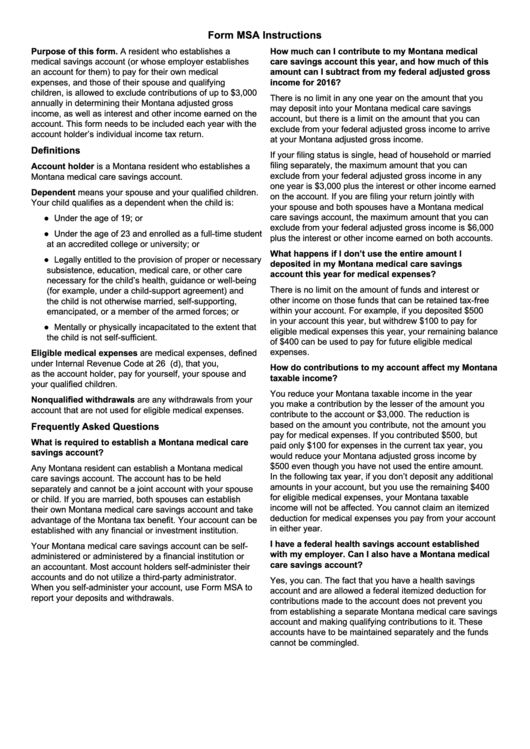

Form MSA Instructions

Purpose of this form. A resident who establishes a

How much can I contribute to my Montana medical

medical savings account (or whose employer establishes

care savings account this year, and how much of this

an account for them) to pay for their own medical

amount can I subtract from my federal adjusted gross

expenses, and those of their spouse and qualifying

income for 2016?

children, is allowed to exclude contributions of up to $3,000

There is no limit in any one year on the amount that you

annually in determining their Montana adjusted gross

may deposit into your Montana medical care savings

income, as well as interest and other income earned on the

account, but there is a limit on the amount that you can

account. This form needs to be included each year with the

exclude from your federal adjusted gross income to arrive

account holder’s individual income tax return.

at your Montana adjusted gross income.

Definitions

If your filing status is single, head of household or married

filing separately, the maximum amount that you can

Account holder is a Montana resident who establishes a

exclude from your federal adjusted gross income in any

Montana medical care savings account.

one year is $3,000 plus the interest or other income earned

Dependent means your spouse and your qualified children.

on the account. If you are filing your return jointly with

Your child qualifies as a dependent when the child is:

your spouse and both spouses have a Montana medical

care savings account, the maximum amount that you can

● Under the age of 19; or

exclude from your federal adjusted gross income is $6,000

● Under the age of 23 and enrolled as a full-time student

plus the interest or other income earned on both accounts.

at an accredited college or university; or

What happens if I don’t use the entire amount I

● Legally entitled to the provision of proper or necessary

deposited in my Montana medical care savings

subsistence, education, medical care, or other care

account this year for medical expenses?

necessary for the child’s health, guidance or well-being

There is no limit on the amount of funds and interest or

(for example, under a child-support agreement) and

other income on those funds that can be retained tax-free

the child is not otherwise married, self-supporting,

within your account. For example, if you deposited $500

emancipated, or a member of the armed forces; or

in your account this year, but withdrew $100 to pay for

● Mentally or physically incapacitated to the extent that

eligible medical expenses this year, your remaining balance

the child is not self-sufficient.

of $400 can be used to pay for future eligible medical

expenses.

Eligible medical expenses are medical expenses, defined

under Internal Revenue Code at 26 U.S.C. 213(d), that you,

How do contributions to my account affect my Montana

as the account holder, pay for yourself, your spouse and

taxable income?

your qualified children.

You reduce your Montana taxable income in the year

Nonqualified withdrawals are any withdrawals from your

you make a contribution by the lesser of the amount you

account that are not used for eligible medical expenses.

contribute to the account or $3,000. The reduction is

based on the amount you contribute, not the amount you

Frequently Asked Questions

pay for medical expenses. If you contributed $500, but

What is required to establish a Montana medical care

paid only $100 for expenses in the current tax year, you

savings account?

would reduce your Montana adjusted gross income by

$500 even though you have not used the entire amount.

Any Montana resident can establish a Montana medical

In the following tax year, if you don’t deposit any additional

care savings account. The account has to be held

amounts in your account, but you use the remaining $400

separately and cannot be a joint account with your spouse

for eligible medical expenses, your Montana taxable

or child. If you are married, both spouses can establish

income will not be affected. You cannot claim an itemized

their own Montana medical care savings account and take

deduction for medical expenses you pay from your account

advantage of the Montana tax benefit. Your account can be

in either year.

established with any financial or investment institution.

I have a federal health savings account established

Your Montana medical care savings account can be self-

with my employer. Can I also have a Montana medical

administered or administered by a financial institution or

care savings account?

an accountant. Most account holders self-administer their

accounts and do not utilize a third-party administrator.

Yes, you can. The fact that you have a health savings

When you self-administer your account, use Form MSA to

account and are allowed a federal itemized deduction for

report your deposits and withdrawals.

contributions made to the account does not prevent you

from establishing a separate Montana medical care savings

account and making qualifying contributions to it. These

accounts have to be maintained separately and the funds

cannot be commingled.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4