Montana Form Msa - Montana Medical Care Savings Account - 2012

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

MONTANA

4

MSA

5

5

Rev 02 12

6

6

7

7

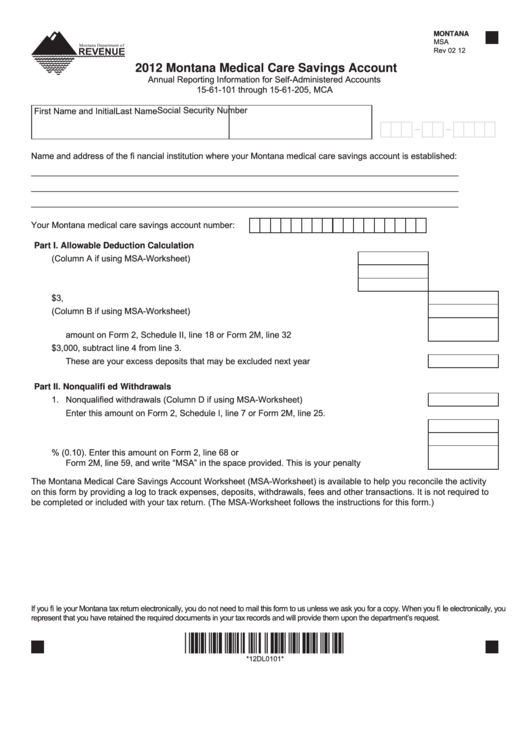

2012 Montana Medical Care Savings Account

8

8

Annual Reporting Information for Self-Administered Accounts

9

9

15-61-101 through 15-61-205, MCA

10

10

11

11

Social Security Number

First Name and Initial

Last Name

12

12

13

13

-

-

14

14

15

15

Name and address of the fi nancial institution where your Montana medical care savings account is established:

16

16

17

17

__________________________________________________________________________________________

18

18

__________________________________________________________________________________________

19

19

20

20

__________________________________________________________________________________________

21

21

22

22

Your Montana medical care savings account number:

23

23

24

24

Part I. Allowable Deduction Calculation

25

25

1. Current year deposits (Column A if using MSA-Worksheet) ....................... 1.

26

26

2. Deposits from prior years not previously deducted .................................... 2.

27

27

3. Add lines 1 and 2 ........................................................................................ 3.

28

28

29

29

4. Enter the lesser of the amount on line 3 or $3,000...................................................................4.

30

30

5. Interest and other income (Column B if using MSA-Worksheet) ..............................................5.

31

31

6. Add lines 4 and 5. This is your Montana Medical Saving Account exclusion. Enter this

32

32

amount on Form 2, Schedule II, line 18 or Form 2M, line 32 ...................................................6.

33

33

34

34

7. If the amount on line 3 is greater than $3,000, subtract line 4 from line 3.

35

35

These are your excess deposits that may be excluded next year ............................................7.

36

36

37

37

Part II. Nonqualifi ed Withdrawals

38

38

39

39

1. Nonqualifi ed withdrawals (Column D if using MSA-Worksheet) ...............................................1.

40

40

Enter this amount on Form 2, Schedule I, line 7 or Form 2M, line 25.

41

41

2. Enter the withdrawals on line 1 made on the last business day in December 2012 ................2.

42

42

3. Subtract line 2 from line 1 .........................................................................................................3.

43

43

44

44

4. Multiply the amount on line 3 by 10% (0.10). Enter this amount on Form 2, line 68 or

45

45

Form 2M, line 59, and write “MSA” in the space provided. This is your penalty .......................4.

46

46

The Montana Medical Care Savings Account Worksheet (MSA-Worksheet) is available to help you reconcile the activity

47

47

on this form by providing a log to track expenses, deposits, withdrawals, fees and other transactions. It is not required to

48

48

be completed or included with your tax return. (The MSA-Worksheet follows the instructions for this form.)

49

49

50

50

51

51

52

52

53

53

54

54

55

55

56

56

57

57

58

58

59

59

If you fi le your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you fi le electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

*12DL0101*

62

63

63

64

64

*12DL0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5