Montana Form Msa - Montana Medical Care Savings Account - 2008

ADVERTISEMENT

MONTANA

MSA

Rev. 07-08

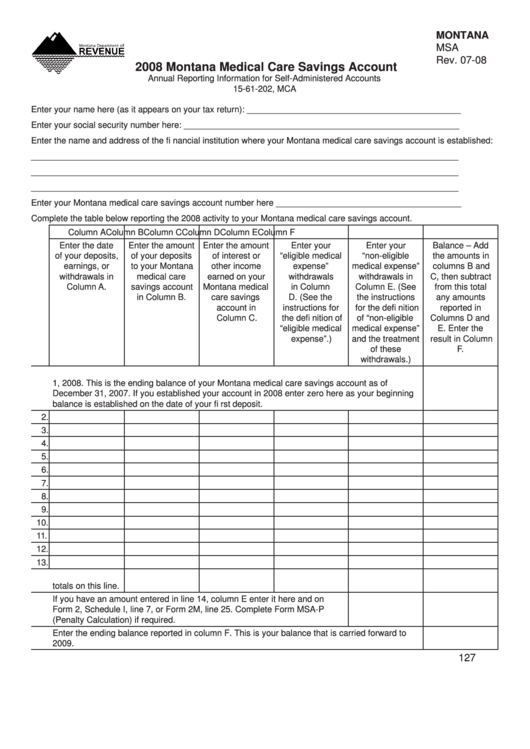

2008 Montana Medical Care Savings Account

Annual Reporting Information for Self-Administered Accounts

15-61-202, MCA

Enter your name here (as it appears on your tax return): _____________________________________________

Enter your social security number here: __________________________________________________________

Enter the name and address of the fi nancial institution where your Montana medical care savings account is established:

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

Enter your Montana medical care savings account number here _______________________________________

Complete the table below reporting the 2008 activity to your Montana medical care savings account.

Column A

Column B

Column C

Column D

Column E

Column F

Enter the date

Enter the amount

Enter the amount

Enter your

Enter your

Balance – Add

of your deposits,

of your deposits

of interest or

“eligible medical

“non-eligible

the amounts in

earnings, or

to your Montana

other income

expense”

medical expense”

columns B and

withdrawals in

medical care

earned on your

withdrawals

withdrawals in

C, then subtract

Column A.

savings account

Montana medical

in Column

Column E. (See

from this total

in Column B.

care savings

D. (See the

the instructions

any amounts

account in

instructions for

for the defi nition

reported in

Column C.

the defi nition of

of “non-eligible

Columns D and

“eligible medical

medical expense”

E. Enter the

expense”.)

and the treatment

result in Column

of these

F.

withdrawals.)

1. Enter in column F the balance of your Montana medical care savings account as of January

1, 2008. This is the ending balance of your Montana medical care savings account as of

December 31, 2007. If you established your account in 2008 enter zero here as your beginning

balance is established on the date of your fi rst deposit.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14. Enter the column

totals on this line.

If you have an amount entered in line 14, column E enter it here and on

Form 2, Schedule I, line 7, or Form 2M, line 25. Complete Form MSA-P

(Penalty Calculation) if required.

Enter the ending balance reported in column F. This is your balance that is carried forward to

2009.

127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2