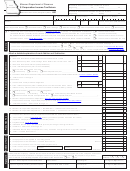

Form Mo-1120s - S Corporation Income/franchise Tax Return - 2000 Page 2

ADVERTISEMENT

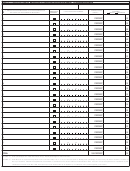

PART 4 — ALLOCATION OF MISSOURI S CORPORATION ADJUSTMENT TO SHAREHOLDERS

CORPORATION NAME

MITS/MO I.D. NUMBER

5. SHAREHOLDER’S CORPORATION

2. CHECK BOX IF

1. NAME OF EACH SHAREHOLDER. ALL SHAREHOLDERS MUST

4. SHAREHOLDER’S

ADJUSTMENT

3. SOCIAL SECURITY NUMBER

SHAREHOLDER IS

BE LISTED. USE ATTACHMENT IF NECESSARY.

SHARE %

NONRESIDENT

ADDITION

SUBTRACTION

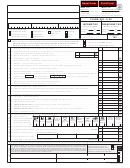

00

a)

—

—

PERCENT

00

b)

—

—

PERCENT

00

c)

—

—

PERCENT

00

d)

—

—

PERCENT

00

e)

—

—

PERCENT

00

f)

—

—

PERCENT

00

g)

—

—

PERCENT

00

h)

—

—

PERCENT

00

i)

—

—

PERCENT

00

j)

—

—

PERCENT

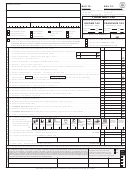

00

k)

—

—

PERCENT

00

l)

—

—

PERCENT

00

m)

—

—

PERCENT

00

n)

—

—

PERCENT

00

o)

—

—

PERCENT

00

p)

—

—

PERCENT

00

q)

—

—

PERCENT

00

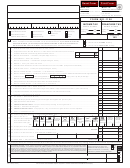

r)

—

—

PERCENT

00

s)

—

—

PERCENT

00

t)

—

—

PERCENT

00

u)

—

—

PERCENT

00

v)

—

—

PERCENT

00

w)

—

—

PERCENT

00

x)

—

—

PERCENT

00

y)

—

—

PERCENT

00

TOTAL

100 PERCENT

COLUMN 4 — Enter percentages from Federal Schedule K-1(s). Round percentages to whole numbers.

COLUMN 5 — Enter Missouri S corporation adjustment from Form MO-1120S, Line 11 or 12, as total of Column 5. Multiply each percentage in Column 4 by the total in Column 5. Indicate at

the top of Column 5 whether the adjustments are additions or subtractions. The amount after each shareholder’s name in Column 5 must be reported as a modification by the

shareholder on his/her Form MO-1040, Individual Income Tax Return either as an addition to, or subtraction from, federal adjusted gross income.

MO 860-1102 (11-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2