Form Pt-01(A) - Annual Insurance Premium Tax Return - 2002 Page 4

ADVERTISEMENT

Nevada Department of Taxation

INSURANCE PREMIUM TAX INSTRUCTIONS

DO NOT INCLUDE INDUSTRIAL INSURANCE (WORKERS COMPENSATION)

This return must be filed even if no tax is due. (For companies required to

file quarterly, the annual return is a summary of the calendar year.)

The Nevada premium tax rate is 3.5%. (Retaliatory statutes, NRS 680A.330

require you to use the higher tax rate charged by Nevada or your

domiciliary state.)

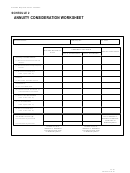

Schedule 1

Line 1 Gross premiums/considerations is defined as all direct premiums written during the year

(including policy, membership and other fees and assessments) and all considerations for insurance,

bail or annuity contracts received on account of policies and contracts covering property or risks

located, resident or to be performed in Nevada, less returned premiums/considerations only.

Considerations received during the year for deferred annuity contracts, if not included in premium,

must be included as gross premiums. Considerations received under an election pursuant to NRS

680B.025(2) are deductible at line 5. Returned considerations are the lesser of the aggregate of

considerations returned or the amount paid out to the contract owner.

Both the gross amounts included at line 1 and line 5 must be reduced by the returned consideration.

( Fill out schedule 2, the annuity consideration worksheet on the reverse side and attach to your

annual return).

Line 3 Policy dividends (life insurance). This figure should be the total dividends paid or credited to

policyholders during the year.

Line 4 Federally qualified plans. Premiums for federally qualified plans are defined as gross

premiums or considerations received during the year for policies or contracts issued in connection

with retirement plans qualified or exempt under sections 401, 403, 404 or 501 of the US Internal

Revenue Code.

Line 5 Other deductions. Entries must be fully supported by schedule and/or explanatory note. NRS

680B.025(2) election deductions must be supported by a statement by an officer of the company,

under oath, declaring the date the election was first made or date the Commissioner of Insurance

approved the election and a list of annuity contract forms (title and form number) to which the

election applies.

Line 7 Taxes payable. If the state of domicile taxes each class of premium at different rates, a

separate schedule calculating the tax in accordance with the domiciliary state method must be

attached and the tax amount entered on line 12 only, state of inc. (do not complete lines 1 through

11).

Annual Return

Lines 1 through 4 If figures for columns A and B differ, penalty and interest may apply.

Line 19 Total premium tax due. If the calculated amount entered on this line results in a negative

figure, this amount is the premium tax overpayment that will be credited to your account. If you owe

premium tax and/or retaliatory assessment, make check payable to the Department of Taxation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4