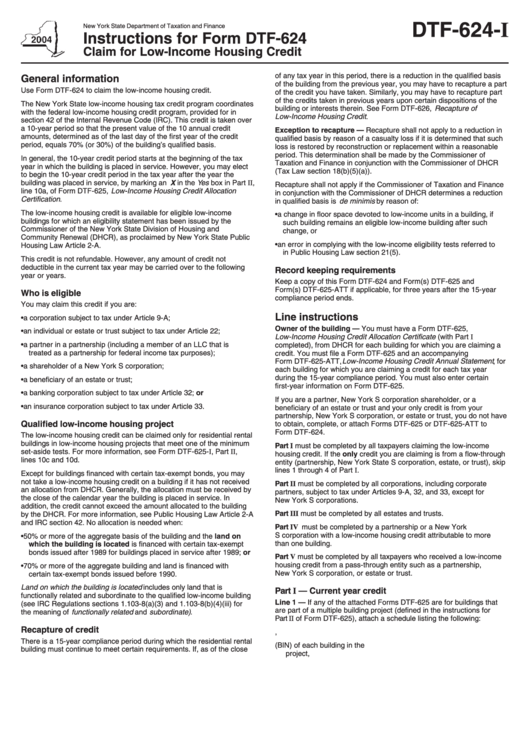

Instructions For Form Dtf-624 - Claim For Low-Income Housing Credit - 2004

ADVERTISEMENT

DTF-624-I

New York State Department of Taxation and Finance

Instructions for Form DTF-624

Claim for Low-Income Housing Credit

of any tax year in this period, there is a reduction in the qualified basis

General information

of the building from the previous year, you may have to recapture a part

Use Form DTF-624 to claim the low-income housing credit.

of the credit you have taken. Similarly, you may have to recapture part

of the credits taken in previous years upon certain dispositions of the

The New York State low-income housing tax credit program coordinates

building or interests therein. See Form DTF-626, Recapture of

with the federal low-income housing credit program, provided for in

Low-Income Housing Credit .

section 42 of the Internal Revenue Code (IRC). This credit is taken over

a 10-year period so that the present value of the 10 annual credit

Exception to recapture — Recapture shall not apply to a reduction in

amounts, determined as of the last day of the first year of the credit

qualified basis by reason of a casualty loss if it is determined that such

period, equals 70% (or 30%) of the building’s qualified basis.

loss is restored by reconstruction or replacement within a reasonable

period. This determination shall be made by the Commissioner of

In general, the 10-year credit period starts at the beginning of the tax

Taxation and Finance in conjunction with the Commissioner of DHCR

year in which the building is placed in service. However, you may elect

(Tax Law section 18(b)(5)(a)).

to begin the 10-year credit period in the tax year after the year the

building was placed in service, by marking an X in the Yes box in Part II,

Recapture shall not apply if the Commissioner of Taxation and Finance

line 10a, of Form DTF-625, Low-Income Housing Credit Allocation

in conjunction with the Commissioner of DHCR determines a reduction

Certification .

in qualified basis is de minimis by reason of:

The low-income housing credit is available for eligible low-income

• a change in floor space devoted to low-income units in a building, if

buildings for which an eligibility statement has been issued by the

such building remains an eligible low-income building after such

Commissioner of the New York State Division of Housing and

change, or

Community Renewal (DHCR), as proclaimed by New York State Public

• an error in complying with the low-income eligibility tests referred to

Housing Law Article 2-A.

in Public Housing Law section 21(5).

This credit is not refundable. However, any amount of credit not

deductible in the current tax year may be carried over to the following

Record keeping requirements

year or years.

Keep a copy of this Form DTF-624 and Form(s) DTF-625 and

Form(s) DTF-625-ATT if applicable, for three years after the 15-year

Who is eligible

compliance period ends.

You may claim this credit if you are:

Line instructions

• a corporation subject to tax under Article 9-A;

Owner of the building — You must have a Form DTF-625,

• an individual or estate or trust subject to tax under Article 22;

Low-Income Housing Credit Allocation Certificate (with Part I

• a partner in a partnership (including a member of an LLC that is

completed), from DHCR for each building for which you are claiming a

treated as a partnership for federal income tax purposes);

credit. You must file a Form DTF-625 and an accompanying

Form DTF-625-ATT, Low-Income Housing Credit Annual Statement , for

• a shareholder of a New York S corporation;

each building for which you are claiming a credit for each tax year

during the 15-year compliance period. You must also enter certain

• a beneficiary of an estate or trust;

first-year information on Form DTF-625.

• a banking corporation subject to tax under Article 32; or

If you are a partner, New York S corporation shareholder, or a

• an insurance corporation subject to tax under Article 33.

beneficiary of an estate or trust and your only credit is from your

partnership, New York S corporation, or estate or trust, you do not have

Qualified low-income housing project

to obtain, complete, or attach Forms DTF-625 or DTF-625-ATT to

Form DTF-624.

The low-income housing credit can be claimed only for residential rental

buildings in low-income housing projects that meet one of the minimum

Part I must be completed by all taxpayers claiming the low-income

set-aside tests. For more information, see Form DTF-625-I, Part II,

housing credit. If the only credit you are claiming is from a flow-through

lines 10c and 10d.

entity (partnership, New York State S corporation, estate, or trust), skip

lines 1 through 4 of Part I.

Except for buildings financed with certain tax-exempt bonds, you may

not take a low-income housing credit on a building if it has not received

Part II must be completed by all corporations, including corporate

an allocation from DHCR. Generally, the allocation must be received by

partners, subject to tax under Articles 9-A, 32, and 33, except for

the close of the calendar year the building is placed in service. In

New York S corporations.

addition, the credit cannot exceed the amount allocated to the building

Part III must be completed by all estates and trusts.

by the DHCR. For more information, see Public Housing Law Article 2-A

and IRC section 42. No allocation is needed when:

Part IV must be completed by a partnership or a New York

S corporation with a low-income housing credit attributable to more

• 50% or more of the aggregate basis of the building and the land on

than one building.

which the building is located is financed with certain tax-exempt

bonds issued after 1989 for buildings placed in service after 1989; or

Part V must be completed by all taxpayers who received a low-income

housing credit from a pass-through entity such as a partnership,

• 70% or more of the aggregate building and land is financed with

New York S corporation, or estate or trust.

certain tax-exempt bonds issued before 1990.

Land on which the building is located includes only land that is

Part I — Current year credit

functionally related and subordinate to the qualified low-income building

Line 1 — If any of the attached Forms DTF-625 are for buildings that

(see IRC Regulations sections 1.103-8(a)(3) and 1.103-8(b)(4)(iii) for

are part of a multiple building project (defined in the instructions for

the meaning of functionally related and subordinate) .

Part II of Form DTF-625), attach a schedule listing the following:

Recapture of credit

1. name and address of the project and each building in the project,

There is a 15-year compliance period during which the residential rental

2. the building identification number (BIN) of each building in the

building must continue to meet certain requirements. If, as of the close

project,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2