Occupational License Tax Return Form - City Of Elkton, Kentucky

ADVERTISEMENT

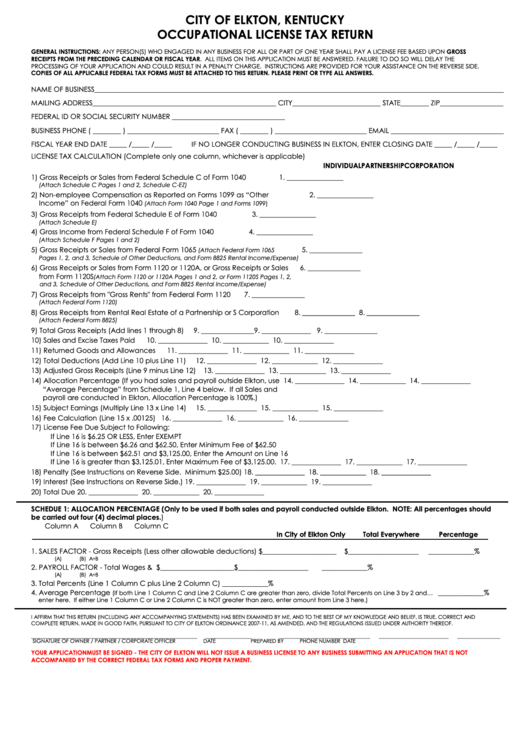

CITY OF ELKTON, KENTUCKY

OCCUPATIONAL LICENSE TAX RETURN

GENERAL INSTRUCTIONS: ANY PERSON(S) WHO ENGAGED IN ANY BUSINESS FOR ALL OR PART OF ONE YEAR SHALL PAY A LICENSE FEE BASED UPON GROSS

RECEIPTS FROM THE PRECEDING CALENDAR OR FISCAL YEAR. ALL ITEMS ON THIS APPLICATION MUST BE ANSWERED. FAILURE TO DO SO WILL DELAY THE

PROCESSING OF YOUR APPLICATION AND COULD RESULT IN A PENALTY CHARGE. INSTRUCTIONS ARE PROVIDED FOR YOUR ASSISTANCE ON THE REVERSE SIDE.

COPIES OF ALL APPLICABLE FEDERAL TAX FORMS MUST BE ATTACHED TO THIS RETURN. PLEASE PRINT OR TYPE ALL ANSWERS.

NAME OF BUSINESS____________________________________________________________________________________________________________________

MAILING ADDRESS____________________________________________________ CITY_________________________ STATE________ ZIP__________________

FEDERAL ID OR SOCIAL SECURITY NUMBER ________________________________

BUSINESS PHONE ( ________ ) __________________________ FAX ( ________ ) __________________________ EMAIL ________________________________

FISCAL YEAR END DATE _____ /_____ /_____

IF NO LONGER CONDUCTING BUSINESS IN ELKTON, ENTER CLOSING DATE _____ /_____ /_____

LICENSE TAX CALCULATION (Complete only one column, whichever is applicable)

INDIVIDUAL

PARTNERSHIP

CORPORATION

1) Gross Receipts or Sales from Federal Schedule C of Form 1040

1. ________________

(Attach Schedule C Pages 1 and 2, Schedule C-EZ)

2) Non-employee Compensation as Reported on Forms 1099 as “Other

2. ________________

Income” on Federal Form 1040

(Attach Form 1040 Page 1 and Forms 1099)

3) Gross Receipts from Federal Schedule E of Form 1040

3. ________________

(Attach Schedule E)

4) Gross Income from Federal Schedule F of Form 1040

4. ________________

(Attach Schedule F Pages 1 and 2)

5) Gross Receipts or Sales from Federal Form 1065

5. _______________

(Attach Federal Form 1065

Pages 1, 2, and 3, Schedule of Other Deductions, and Form 8825 Rental Income/Expense)

6) Gross Receipts or Sales from Form 1120 or 1120A, or Gross Receipts or Sales

6. _______________

from Form 1120S

(Attach Form 1120 or 1120A Pages 1 and 2, or Form 1120S Pages 1, 2,

and 3, Schedule of Other Deductions, and Form 8825 Rental Income/Expense)

7) Gross Receipts from "Gross Rents" from Federal Form 1120

7. _______________

(Attach Federal Form 1120)

8) Gross Receipts from Rental Real Estate of a Partnership or S Corporation

8. _______________ 8. _______________

(Attach Federal Form 8825)

9) Total Gross Receipts (Add lines 1 through 8)

9. _______________ 9. ______________ 9. _______________

10) Sales and Excise Taxes Paid

10. ______________ 10. _____________ 10. ______________

11) Returned Goods and Allowances

11. ______________ 11. _____________ 11. ______________

12) Total Deductions (Add Line 10 plus Line 11)

12. ______________ 12. _____________ 12. ______________

13) Adjusted Gross Receipts (Line 9 minus Line 12)

13. ______________ 13. _____________ 13. ______________

14) Allocation Percentage (If you had sales and payroll outside Elkton, use

14. ______________ 14. _____________ 14. ______________

“Average Percentage” from Schedule 1, Line 4 below. If all Sales and

payroll are conducted in Elkton, Allocation Percentage is 100%.)

15) Subject Earnings (Multiply Line 13 x Line 14)

15. ______________ 15. _____________ 15. ______________

16) Fee Calculation (Line 15 x .00125)

16. ______________ 16. _____________ 16. ______________

17) License Fee Due Subject to Following:

If Line 16 is $6.25 OR LESS, Enter EXEMPT

If Line 16 is between $6.26 and $62.50, Enter Minimum Fee of $62.50

If Line 16 is between $62.51 and $3,125.00, Enter the Amount on Line 16

If Line 16 is greater than $3,125.01, Enter Maximum Fee of $3,125.00.

17. ______________ 17. _____________ 17. ______________

18) Penalty (See Instructions on Reverse Side. Minimum $25.00)

18. ______________ 18. _____________ 18. ______________

19) Interest (See Instructions on Reverse Side.)

19. ______________ 19. _____________ 19. ______________

20) Total Due

20. ______________ 20. _____________ 20. ______________

SCHEDUE 1: ALLOCATION PERCENTAGE (Only to be used if both sales and payroll conducted outside Elkton. NOTE: All percentages should

be carried out four (4) decimal places.)

Column A

Column B

Column C

In City of Elkton Only

Total Everywhere

Percentage

1. SALES FACTOR - Gross Receipts (Less other allowable deductions).... $_____________________

$____________________

_____________%

(A)

(B)

A÷B

2. PAYROLL FACTOR - Total Wages & Salaries............................................ $_____________________

$____________________

_____________%

(A)

(B)

A÷B

3. Total Percents (Line 1 Column C plus Line 2 Column C).................................................................................................................. _____________%

4. Average Percentage

_____________%

(If both Line 1 Column C and Line 2 Column C are greater than zero, divide Total Percents on Line 3 by 2 and…

enter here. If either Line 1 Column C or Line 2 Column C is NOT greater than zero, enter amount from Line 3 here.)

I AFFIRM THAT THIS RETURN (INCLUDING ANY ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IS TRUE, CORRECT AND

COMPLETE RETURN, MADE IN GOOD FAITH, PURSUANT TO CITY OF ELKTON ORDINANCE 2007-11, AS AMENDED, AND THE REGULATIONS ISSUED UNDER AUTHORITY THEREOF.

______________________________________________________________

_________________

__________________________________

__________________________

________________

SIGNATURE OF OWNER / PARTNER / CORPORATE OFFICER

DATE

PREPARED BY

PHONE NUMBER

DATE

YOUR APPLICATION MUST BE SIGNED - THE CITY OF ELKTON WILL NOT ISSUE A BUSINESS LICENSE TO ANY BUSINESS SUBMITTING AN APPLICATION THAT IS NOT

ACCOMPANIED BY THE CORRECT FEDERAL TAX FORMS AND PROPER PAYMENT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1