Occupational License Tax Return - The City Of Elkton

ADVERTISEMENT

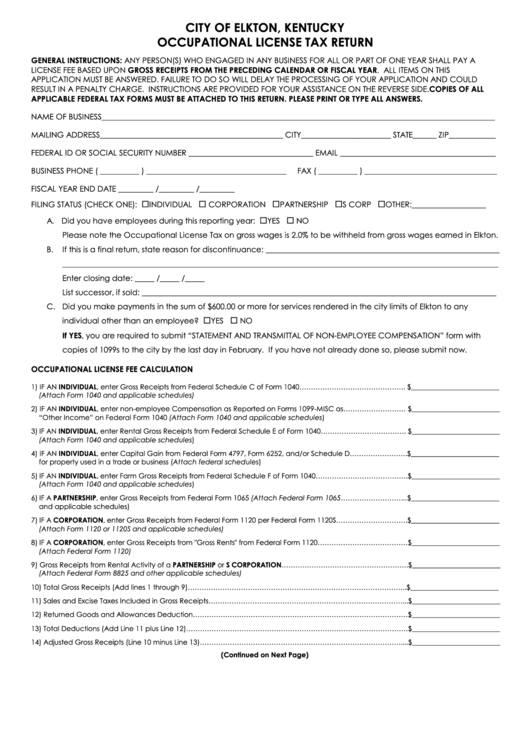

CITY OF ELKTON, KENTUCKY

OCCUPATIONAL LICENSE TAX RETURN

GENERAL INSTRUCTIONS: ANY PERSON(S) WHO ENGAGED IN ANY BUSINESS FOR ALL OR PART OF ONE YEAR SHALL PAY A

LICENSE FEE BASED UPON GROSS RECEIPTS FROM THE PRECEDING CALENDAR OR FISCAL YEAR. ALL ITEMS ON THIS

APPLICATION MUST BE ANSWERED. FAILURE TO DO SO WILL DELAY THE PROCESSING OF YOUR APPLICATION AND COULD

RESULT IN A PENALTY CHARGE. INSTRUCTIONS ARE PROVIDED FOR YOUR ASSISTANCE ON THE REVERSE SIDE. COPIES OF ALL

APPLICABLE FEDERAL TAX FORMS MUST BE ATTACHED TO THIS RETURN. PLEASE PRINT OR TYPE ALL ANSWERS.

NAME OF BUSINESS_____________________________________________________________________________________________________

MAILING ADDRESS_______________________________________________ CITY_______________________ STATE______ ZIP____________

FEDERAL ID OR SOCIAL SECURITY NUMBER ________________________________ EMAIL ________________________________________

BUSINESS PHONE ( __________ ) ____________________________________

FAX ( __________ ) __________________________________

FISCAL YEAR END DATE _________ /_________ /_________

FILING STATUS (CHECK ONE):

INDIVIDUAL

CORPORATION

PARTNERSHIP

S CORP

OTHER:___________________

A. Did you have employees during this reporting year:

YES

NO

Please note the Occupational License Tax on gross wages is 2.0% to be withheld from gross wages earned in Elkton.

B.

If this is a final return, state reason for discontinuance: ____________________________________________________________

________________________________________________________________________________________________________________

Enter closing date: _____ /_____ /_____

List successor, if sold: ___________________________________________________________________________________________

C. Did you make payments in the sum of $600.00 or more for services rendered in the city limits of Elkton to any

individual other than an employee?

YES

NO

If YES, you are required to submit “STATEMENT AND TRANSMITTAL OF NON-EMPLOYEE COMPENSATION” form with

copies of 1099s to the city by the last day in February. If you have not already done so, please submit now.

OCCUPATIONAL LICENSE FEE CALCULATION

1) IF AN INDIVIDUAL, enter Gross Receipts from Federal Schedule C of Form 1040………………………………………. $_________________________

(Attach Form 1040 and applicable schedules)

2) IF AN INDIVIDUAL, enter non-employee Compensation as Reported on Forms 1099-MISC as……………………… $_________________________

“Other Income” on Federal Form 1040 (Attach Form 1040 and applicable schedules)

3) IF AN INDIVIDUAL, enter Rental Gross Receipts from Federal Schedule E of Form 1040………………………………. $_________________________

(Attach Form 1040 and applicable schedules)

4) IF AN INDIVIDUAL, enter Capital Gain from Federal Form 4797, Form 6252, and/or Schedule D…………………….$_________________________

for property used in a trade or business (Attach federal schedules)

5) IF AN INDIVIDUAL, enter Farm Gross Receipts from Federal Schedule F of Form 1040………………………………….$_________________________

(Attach Form 1040 and applicable schedules)

6) IF A PARTNERSHIP, enter Gross Receipts from Federal Form 1065 (Attach Federal Form 1065………………………..$_________________________

and applicable schedules)

7) IF A CORPORATION, enter Gross Receipts from Federal Form 1120 per Federal Form 1120S………………………….$_________________________

(Attach Form 1120 or 1120S and applicable schedules)

8) IF A CORPORATION, enter Gross Receipts from "Gross Rents" from Federal Form 1120…………………………………$_________________________

(Attach Federal Form 1120)

9) Gross Receipts from Rental Activity of a PARTNERSHIP or S CORPORATION……………………………………………….$_________________________

(Attach Federal Form 8825 and other applicable schedules)

10) Total Gross Receipts (Add lines 1 through 9)…………………………………………………………………………………..$_________________________

11) Sales and Excise Taxes Included in Gross Receipts…………………………………………………………………………...$_________________________

12) Returned Goods and Allowances Deduction…………………………………………………………………………………$_________________________

13) Total Deductions (Add Line 11 plus Line 12)……………………………………………………………………………………$_________________________

14) Adjusted Gross Receipts (Line 10 minus Line 13)……………………………………………………………………………....$_________________________

(Continued on Next Page)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2