Page 3

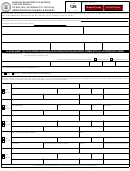

Is this business located inside the city limits of any city or municipality in Missouri? For help determining this visit https://dors.mo.gov/tax/strgis/index.jsp.

r

r

No

Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community, or transportation development.

r

r

No

Yes - Specify the district name(s):

r

r

Change Sales and Use Tax Filing Frequency To:

Monthly ($500 or more per month in tax)

Quarterly (Less than $500 per month in tax)

r

Annually (Less than $100 per quarter in sales tax)

*Continue current filing until this change is verified by the Department.

Do you make retail sales of the following items? Select all that apply.

r

r

r

r

Alcoholic Beverages

Alternative Nicotine

Cigarettes or Other Tobacco Products

Domestic Utilities

r

r

r

E-Cigarettes or Vapor Products

Food Subject to Reduced State Food Tax Rate

Items Qualifying for Show Me Green Sales Tax Holiday

r

r

r

Items Qualifying for Back-To-School Sales Tax Holiday

Lead-Acid Batteries

Lease or Rent Motor Vehicles

r

r

r

New Tires

Post-Secondary Educational Textbooks

Telecommunication Services

r

Qualifying Utilities or Items Used or Consumed in Manufacturing or Mining, Research and Development, or Processing Recovered Materials.

r

r

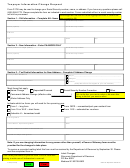

Do you make retail sales of aviation jet fuel to Missouri customers? ..............................................................................................

Yes

No

r

r

If yes, are your sales made at:

A Missouri airport

A location outside Missouri and the fuel is transported into Missouri?

r

r

If yes, is the airport located in Missouri and identified on the National Plan of Integrated Airport Systems (NPIAS)? .....................

Yes

No

If yes, provide a list of applicable locations. ________________________________________________________________________________

r

r

Do you use, store, or consume aviation jet fuel in Missouri where the seller does not collect tax? .................................................

Yes

No

r

r

If yes, is the fuel stored, used, or consumed in an airport that is identified on the NPIAS? ............................................................

Yes

No

If yes, provide a list of applicable locations: ________________________________________________________________________________

r

I would like to change from a transient employer to a regular employer.

(Must have filed 24 consecutive months in Missouri)

Change the corporation taxable year end to:

Change* Withholding Tax Filing Frequency To:

r

*Continue current

Annually (less than $100 withholding tax per quarter)

filing until this

(MM/DD) __ __ / __ __

r

Quarterly ($100 withholding tax per quarter to $499 per month)

change is verified

r

by the Department.

Monthly ($500 to $9,000 withholding tax per month)

r

Quarter-Monthly (weekly) (over $9,000 withholding tax per month,

required to pay electronically)

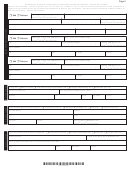

Comments

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. This form must be signed by the owner, if

the business is a sole ownership; partner, if the business is a partnership; reported officer, if the business is a corporation, or by a member, if the business is an L.L.C.

No digital signatures allowed

as reported on the application.

Signature

Printed Name

Title

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Registration Change

*15600030001*

Mail to:

Taxation Division

Phone: (573) 751-5860

15600030001

P.O. Box 3300

TTY: (800) 735-2966

Jefferson City, MO 65105-3300

Fax: (573) 522-1722

E-mail:

businesstaxregister@dor.mo.gov

Exemption Change

Visit

Mail to:

Taxation Division

Phone: (573) 751-2836

for additional information.

P.O. Box 358

TTY: (800) 735-2966

Jefferson City, MO 65105-0358

Fax: (573) 522-1271

E-mail:

salestaxexemptions@dor.mo.gov

Form 126 (Revised 11-2016)

1

1 2

2 3

3