Instructions For Form Hpc - Application For Homestead Preservation Credit - 2005 Page 3

ADVERTISEMENT

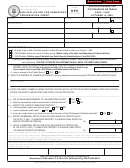

2005 FORM HPC

MAILING ADDRESS

Print or type your mailing address, telephone

INSTRUCTIONS

number, city, state and zip code in the space(s)

provided.

IMPORTANT FILING INFORMATION

LINE 1 — VERIFICATION OF

This information is for guidance only and does

DISABILITY

not state the complete law.

If claiming credit eligibility due to disability, you

must attach a copy of one of the following

WHEN TO FILE APPLICATION

approved forms of verification:

The 2004 Form HPC must be postmarked

between April 1, 2005 and September 30,

• Letter from the Veterans Administration

2005. However, most county assessors will

stating you are 100 percent disabled as a

not have the information required to com-

result of military service. To request a

plete the application until June 2005. To

copy of the letter call the Veterans

ensure your application is completed and

Administration at (800) 827-1000.

mailed on time, it is best to wait until after June

• Letter from Social Security Administration

1 to bring your application to the assessor's

and/or Form SSA-1099

office to be completed.

LINE 2 — FEDERAL

If your application and required attachments

ADJUSTED INCOME

are postmarked after September 30, 2005,

To be eligible for the Homestead Preservation

your credit will be denied.

Credit your 2004 Federal Adjusted Income,

either alone if filing as a single or with your

spouse if married filing jointly, must be $70,000

or less.

Enter the amount of your Federal

INFORMATION FOR

Adjusted Income in the space provided. If you

have not filed a 2004 Missouri Income Tax

APPLICANT TO

Return, you must attach a copy of your 2004

COMPLETE HOMESTEAD

Federal Income Tax return, pages 1 and 2.

Your application will be rejected if you do

PRESERVATION CREDIT

not attach these pages as required.

APPLICATION

If you are not required to file a 2004 Federal

NAME, BIRTHDATE, AGE AND

Income Tax Return, insert "Not Required to

File" in the space provided. NOTE:You may be

SOCIAL SECURITY NUMBER

eligible for the Property Tax Credit (MO-PTC)

Print or type your name(s), birth date(s), age(s)

if you were not required to file a 2004

and social security number(s) in the space(s)

Federal Income Tax Return. You will need to

provided. If you or your spouse do not have a

determine which tax credit is more benefi-

social security number, enter "none" in the

cial to you.

appropriate space(s).

If married, enter both

birth dates, even if your spouse died during the

LINE 3 — ADDRESS OF

calendar year.

HOMESTEAD PROPERTY

Print or type the street address of the home-

100% DISABLED QUALIFICATION

stead property for which credit is being applied.

If you or your spouse is 100% disabled, check

NOTE: "Homestead" is the dwelling owned

the appropriate box. Verification of disability is

and occupied by the claimant and up to five

required. See Line 1 instructions.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6