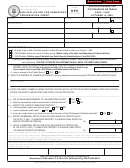

Instructions For Form Hpc - Application For Homestead Preservation Credit - 2005 Page 4

ADVERTISEMENT

acres of land surrounding it if reasonably

INFORMATION FOR COUNTY

necessary for use of the dwelling as a home.

ASSESSOR TO COMPLETE

Property jointly owned with children or held

HOMESTEAD PRESERVA-

in a trust is not eligible.

TION CREDIT APPLICATION

**If the eligible owner dies or transfers owner-

LINE 1 — OWNER OF RECORD

ship of the property after mailing the applica-

The County Assessor's Office must enter the

tion, you must notify the Department of

owner of record of the homestead property as

Revenue.

of January 1, 2005 in the space(s) provided.

Property jointly owned with children or held

LINE 4 — IMPROVEMENTS

in a trust is not eligible.

If improvements made during calendar year

2004 total more than five percent of the

**If you receive notice that an eligible owner has

appraised value, you do not qualify for the

died or transferred ownership of the property

Homestead Preservation Credit.

after the homestead exemption limit has been

set, but prior to the mailing of the tax bill, you

LINE 5 — PROPERTY TAX RECEIPTS

must notify the Department of Revenue.

To qualify for the Homestead Preservation

Credit, you must include a copy of your paid

LINE 2 — PARCEL NUMBER

real estate property tax receipt and/or paid per-

The County Assessor's Office must enter the

sonal property tax receipt if the homestead

parcel number of the homestead property in the

property is a mobile home for the tax years

space(s) provided.

2003 and 2004. If you did not own the proper-

ty in 2003 and 2004, you are not eligible for the

LINE 3 — AMOUNT OF ACREAGE

credit. A copy of cancelled checks or your

CLASSIFIED AS RESIDENTIAL

mortgage statement is not a paid receipt

The County Assessor's Office must enter the

and will not be accepted.

amount of acreage classified as residential on

the Assessor's property card in the space(s)

SIGNATURE AND DATE

provided.

You must sign and date your Form HPC in the

appropriate space(s). If married, both spouses

LINE 4 — AMOUNT OF NEW

must sign the application.

CONSTRUCTION/IMPROVEMENTS

DURING 2004

YOU MUST HAVE YOUR COUNTY ASSES-

The County Assessor's Office must enter the

SOR COMPLETE PAGE 2 OF THE APPLICA-

amount of any new construction or improve-

TION.

ments during 2004 calendar year in the

space(s) provided.

LINES 5 AND 6 — ASSESSED

VALUATION OF HOMESTEAD

The County Assessor's Office must enter the

assessed valuation of the homestead for the

NOTE: "home-

2004 and 2005 tax years.

stead" is the dwelling owned and occupied

by the claimant and up to five acres of land

surrounding it if reasonably necessary for

use of the dwelling as a home.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6