Form Ucs-3 - Employer Account Change

ADVERTISEMENT

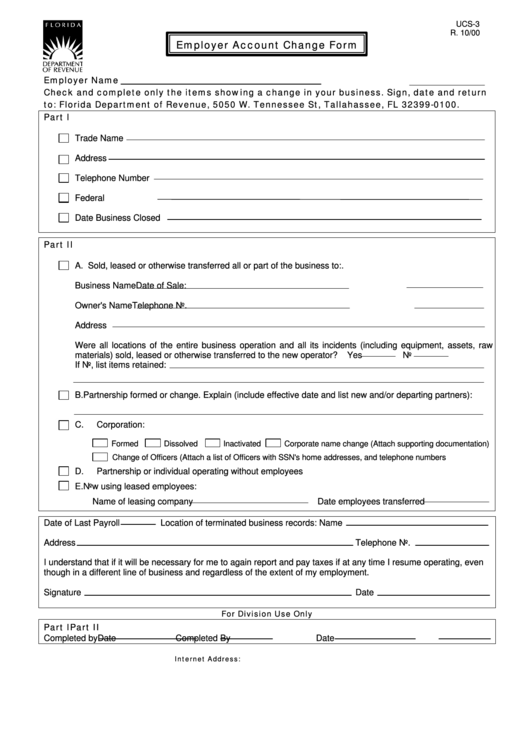

UCS-3

R. 10/00

Employer Account Change Form

Employer Name

U.C. Account No.

Check and complete only the items showing a change in your business. Sign, date and return

to: Florida Department of Revenue, 5050 W. Tennessee St, Tallahassee, FL 32399-0100.

Part I

Trade Name

Address

Telephone Number

Federal I.D. Number

Date Business Closed

Part II

A. Sold, leased or otherwise transferred all or part of the business to:.

Business Name

Date of Sale:

Owner's Name

Telephone No.

Address

Were all locations of the entire business operation and all its incidents (including equipment, assets, raw

materials) sold, leased or otherwise transferred to the new operator?

Yes

No

If No, list items retained:

B. Partnership formed or change. Explain (include effective date and list new and/or departing partners):

C. Corporation:

Formed

Dissolved

Inactivated

Corporate name change (Attach supporting documentation)

Change of Officers (Attach a list of Officers with SSN's home addresses, and telephone numbers

D. Partnership or individual operating without employees

E. Now using leased employees:

Name of leasing company

Date employees transferred

Date of Last Payroll

Location of terminated business records: Name

Address

Telephone No.

I understand that if it will be necessary for me to again report and pay taxes if at any time I resume operating, even

though in a different line of business and regardless of the extent of my employment.

Signature

Date

For Division Use Only

Part I

Part II

Completed by

Date

Completed By

Date

Internet Address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1