Form 150-504-004 - Confidential Personal Property Return 2001 Page 2

ADVERTISEMENT

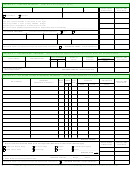

SCHEDULE 3 — FLOATING PROPERTY

(Enter “None” if no property to report)

Registration No.

Oregon Marine Board No.

Date Purchased

Purchase Price

Owner’s Opinion

Assessor’s RMV

$

of Market Value

(Leave blank)

Own:

Contract Holder:

Exact Moorage Location on January 1

Fee Simple

Contract

If you have remodeled your floating property during the

past year, please describe in the space to the right.

(This may include a room or story addition, stringer

replacement, or acquisition of a tender house or swim

float.) Also report partially completed structures.

Approximate date of remodeling: ____________________________

ALL OTHER VESSELS

Does this vessel ply the high seas?

YES

NO

Registration No.

Date Purchased

Purchase Price

Name of Vessel

Primary Moorage

Length of Vessel

Type of Fishing or Activity

If Schedule 3 items are reported on separate attachments, check here:

Schedule 3 TOTAL:

(Include attachments)

SCHEDULE 4 — PROFESSIONAL LIBRARIES

(Use this format and report on a separate sheet. Enter “None” if no property to report)

1

2

5

6

7

8

Owner’s Opinion of

If set, is it complete?

Number of

Cost When

Assessor’s RMV

Market Value

Type of Library *

Title of Book or Set

Volumes

Purchased

(Leave blank)

3

4

NO

YES

TOTAL

* For example, books, tapes,

Schedule 4 TOTAL:

(Include attachments)

videos, compact discs.

SCHEDULE 5 — ALL OTHER TAXABLE PERSONAL PROPERTY

(Not reported on Schedules 1, 2, 3, or 4)

1

2

3

4

5

6

7

8

Pur-

Cost When

Owner’s Opinion

Identification

Model

chased

No. of

Purchased

of Market Value

Assessor’s RMV

Item of Property

(Manufacturer or Serial No.)

Year

Units

(leave blank)

EACH

TOTAL

TOTAL

Mo.

Yr.

Subtotal All Other

9

Report value of all small hand tools not reported elsewhere on this return

Owner’s Opinion

Assessor’s RMV

(Indicate type)

of Market Value

(leave blank)

Barber and Beauty Shop

Service Garage

Medical

Construction/Logging

Radio and TV Shop

Landscape

Dental

Other _________________

Subtotal Tools

Improvements on federal lands, mining claims, etc.,

LOCATION: Township _______ Range _______ Section _______

on which final proof has not yet been made:

If Schedule 5 items are reported on separate attachments, check here:

Schedule 5 TOTAL:

(Include attachments)

2

Submit your original return and attachments to your county assessor. Keep a photocopy and the attached instructions for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2