Form Nh 706 - New Hampshire Estate Tax Return - General Instructions

ADVERTISEMENT

FORM

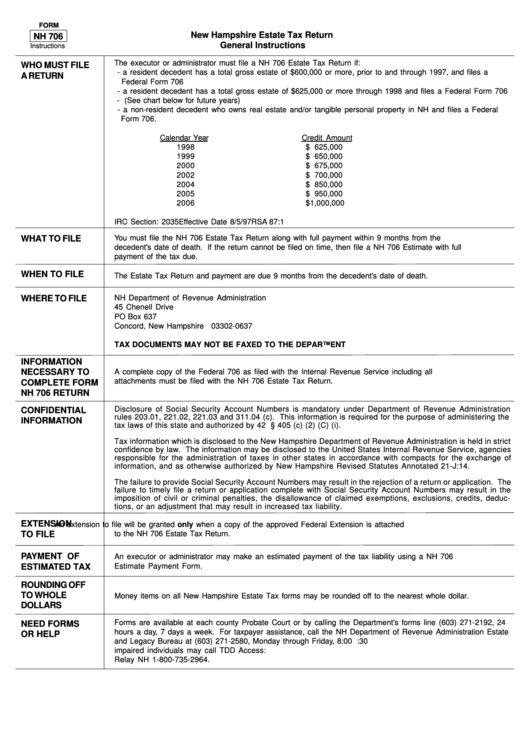

New Hampshire Estate Tax Return

NH 706

General Instructions

Instructions

The executor or administrator must file a NH 706 Estate Tax Return if:

WHO MUST FILE

- a resident decedent has a total gross estate of $600,000 or more, prior to and through 1997, and files a

A RETURN

Federal Form 706

- a resident decedent has a total gross estate of $625,000 or more through 1998 and files a Federal Form 706

- (See chart below for future years)

- a non-resident decedent who owns real estate and/or tangible personal property in NH and files a Federal

Form 706.

Calendar Year

Credit Amount

1998

$ 625,000

1999

$ 650,000

2000

$ 675,000

2002

$ 700,000

2004

$ 850,000

2005

$ 950,000

2006

$1,000,000

IRC Section: 2035

Effective Date 8/5/97

RSA 87:1

You must file the NH 706 Estate Tax Return along with full payment within 9 months from the

WHAT TO FILE

decedent's date of death. If the return cannot be filed on time, then file a NH 706 Estimate with full

payment of the tax due.

WHEN TO FILE

The Estate Tax Return and payment are due 9 months from the decedent's date of death.

WHERE TO FILE

NH Department of Revenue Administration

45 Chenell Drive

PO Box 637

Concord, New Hampshire

03302-0637

TAX DOCUMENTS MAY NOT BE FAXED TO THE DEPARTMENT

INFORMATION

NECESSARY TO

A complete copy of the Federal 706 as filed with the Internal Revenue Service including all

attachments must be filed with the NH 706 Estate Tax Return.

COMPLETE FORM

NH 706 RETURN

Disclosure of Social Security Account Numbers is mandatory under Department of Revenue Administration

CONFIDENTIAL

rules 203.01, 221.02, 221.03 and 311.04 (c). This information is required for the purpose of administering the

INFORMATION

tax laws of this state and authorized by 42 U.S.C.S. § 405 (c) (2) (C) (i).

Tax information which is disclosed to the New Hampshire Department of Revenue Administration is held in strict

confidence by law. The information may be disclosed to the United States Internal Revenue Service, agencies

responsible for the administration of taxes in other states in accordance with compacts for the exchange of

information, and as otherwise authorized by New Hampshire Revised Statutes Annotated 21-J:14.

The failure to provide Social Security Account Numbers may result in the rejection of a return or application. The

failure to timely file a return or application complete with Social Security Account Numbers may result in the

imposition of civil or criminal penalties, the disallowance of claimed exemptions, exclusions, credits, deduc-

tions, or an adjustment that may result in increased tax liability.

EXTENSION

An extension to file will be granted only when a copy of the approved Federal Extension is attached

to the NH 706 Estate Tax Return.

TO FILE

PAYMENT OF

An executor or administrator may make an estimated payment of the tax liability using a NH 706

ESTIMATED TAX

Estimate Payment Form.

ROUNDING OFF

TO WHOLE

Money items on all New Hampshire Estate Tax forms may be rounded off to the nearest whole dollar.

DOLLARS

Forms are available at each county Probate Court or by calling the Department's forms line (603) 271-2192, 24

NEED FORMS

hours a day, 7 days a week. For taxpayer assistance, call the NH Department of Revenue Administration Estate

OR HELP

and Legacy Bureau at (603) 271-2580, Monday through Friday, 8:00 a.m. to 4:30 p.m. Hearing and/or speech

impaired individuals may call TDD Access:

Relay NH 1-800-735-2964.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3