Form 211-T - Calculation Of Wages Earned Outside Of Fayette County - 2015 Page 2

ADVERTISEMENT

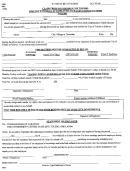

CALCULATION OF WAGES EARNED OUTSIDE OF FAYETTE COUNTY

PART III - Schedule of Days or Hours Spent Working Outside of Fayette County

If additional space is needed, use photocopies of this page. Make sure you attach all pages to the refund form.

Schedule must be based upon actual working time. DO NOT use commissions, mileage etc.

Any time spent working (preparing reports, making business related telephone calls, etc.) from your

Fayette County home or office is considered time inside Fayette County.

If you worked from home in another Kentucky jurisdiction, you may owe the Occupational tax to that

jurisdiction.

The information contained in the application may be shared with other taxing jurisdictions.

You MUST provide the location where work outside the county was performed

DAYS or HOURS

DATE

LOCATION

(a)

(b)

(c)

TOTAL this page

TOTAL other pages

GRAND TOTAL

FORM 211-T, Revised 12-2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2