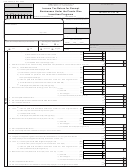

Form 480.30(Ii)di - Income Tax Return For Exempt Businesses Under The Puerto Rico Incentives Programs Industrial Development Page 3

ADVERTISEMENT

Form 480.30(II)DI

Industrial Development

Incentives

- Page 3

Rev. 06.12

Questionnaire

1.

If a foreign corporation, indicate if the trade or business in Puerto Rico was

Yes No

Yes No

Have you been audited by the Federal Internal Revenue Service? .......

10.

(10)

(1)

held as a branch .............................................................................

Which years?_________________________________________________

2.

If a branch, indicate the percent that represents the income from sources

11.

Did the exempt business distribute dividends other than stock dividends

within Puerto Rico from the total income of the exempt business:_______%

or distributions in liquidation in excess of the current and accumulated

3.

Did the exempt business keep any part of its records on a computerized

earnings during this year?...................................................................

(11)

system during this year? .................................................................

(3)

Is the exempt business a partner in a special partnership?(If more than

12.

4.

The exempt business books are in care of:

one, submit detail) ...........................................................................

(12)

Name _______________________________________________________

Name of the Special Partnership _________________________________

Address _____________________________________________________

Employer identification number __________________________________

_____________________________________________________________

Did the corporation at the end of the taxable year own, directly or indirectly,

13.

E-mail _______________________________________________________

50% or more of the voting stocks of a corporation who is engaged in trade

Telephone ____________________________________________________

or business in Puerto Rico? .............................................................

(13)

5.

Indicate accounting method used:

If “Yes”, attach a schedule showing: (a) name and employer identification

Cash

Accrual

number, (b) percentage owned, and (c) taxable income (or loss) before

Other (specify): _____________________________________

net operating loss and special deductions of the corporation for the taxable

6.

Did the exempt business file the following documents?

year (even when such taxable year does not coincide with the one of the

(a)

(6a)

Informative Return (Forms 480.5, 480.6A, 480.6B) ........................

corporation or partnership for which this return is filed).

(b)

Withholding Statement (Form 499R-2/W-2PR) ...............................

(6b)

14.

Did any individual, partnership, corporation, estate or trust at the end of the

7.

If the gross income exceeds $3,000,000, did you submit financial statements

taxable year own, directly or indirectly, 50% or more of the corporation's

(7)

audited by a CPA licensed in Puerto Rico? ...........................................

voting stocks? If “Yes”, attach a schedule showing the name and employer

(14)

8.

Number of employees during the year: ___________________________

identification number

(a)

Production:_________ (b) Non-production:____________________

Enter the percentage owned:

%

9.

Did the corporation claim expenses connected to the ownership, use,

Enter the amount of exempt interest: _______________________________

15.

maintenance and depreciation of:

Does the exempt business have other exempt activities not covered

16.

(a)

(9a)

Vehicles? ...................................................................................

under the Industrial Incentives Acts? (Attach schedule) ........................

(16)

(b)

(9b)

Vessels? ...................................................................................

Under which Act? _____________________________________________

(17)

(1) Did more than 80% of the total income was derived from activities

17.

Have you made a timely election under:

exclusively related to fishing or transportation of passengers or

Section 3(f) Act No. 8 of 1987

cargo or lease? .................................................................

(9b1)

Section 6(f) Act No. 135-1997

(c)

(9c)

Aircrafts

.......................................................................

Section 10(b) Act No. 73-2008

?

18.

Enter the total amount of charitable contributions to

(1) Did more than 80% of the total income was derived from activities

municipalities claimed during the taxable year: ______________________

exclusively related to transportation of passengers or

19.

Indicate if your books reflect premiums paid by unauthorized insurers ....

(19)

cargo or lease? .................................................................

(9c1)

Indicate the method used to allocate expenses:

20.

(d)

Residential property outside of Puerto Rico? .....................................

(9d)

Profit - Split

Cost Sharing

Others _____________

(1) Did more than 80% of the total income was derived from activities

21.

Employer number assigned by the Department of Labor and

(9d1)

exclusively related to the lease of property to non related persons?

Human Resources ___________________________________________

(e)

Housing? (except business employees) ....................................

(9e)

(f)

Employees attending conventions or meetings outside Puerto Rico

(9f)

or the United States? ...........................................................

Compensation to officers

Percentage of

Percentage of time

Compensation

stocks owned

Name of officer

Social security number

devoted to business

Common

Preferred

00

00

00

00

00

00

Total compensation to officers ..........................................................................................................................................................

00

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3