Page 2

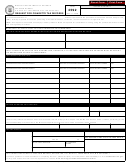

CITY

STREET ADDRESS - DO NOT USE PO BOX OR RURAL ROUTE

STATE

ZIP CODE

COUNTY

Is this business located inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp

No

Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes - Specify the district name(s):

CITY

STREET ADDRESS - DO NOT USE PO BOX OR RURAL ROUTE

STATE

ZIP CODE

COUNTY

Is this business located inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp

No

Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes - Specify the district name(s):

STREET ADDRESS - DO NOT USE PO BOX OR RURAL ROUTE

CITY

STATE

ZIP CODE

COUNTY

Is this business located inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp

No

Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes - Specify the district name(s):

STREET ADDRESS - DO NOT USE PO BOX OR RURAL ROUTE

CITY

STATE

ZIP CODE

COUNTY

Is this business located inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp

No

Yes - Specify the city:

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes - Specify the district name(s):

6.

ATTACHMENTS

Sales Tax Rule 12 CSR 10-104.040 provides in part that records must be submitted to demonstrate that the business or corporation annually purchases

non-resalable items in excess of $750,000. Attach invoices and statements to demonstrate you have annual purchases in excess of $750,000.

7.

SIGNATURE

Under penalties of perjury, I declare that the above information and any attached supplements are true, complete and correct. The application must be signed by

the owner, if the business is a sole ownership; partner, if the business is a partnership; reported officer, if the business is a corporation or by a member, if the busi-

ness is an L.L.C. as reported on this application.

SIGNATURE OF OFFICER

TITLE

PRINT NAME

DATE

E-MAIL ADDRESS

CONFIDENTIALITY OF TAX RECORDS

Missouri Statute 32.057, RSMo, states that all tax records and information maintained by the Missouri Department of Revenue are confidential. The tax information

can only be given to the owner, partner, member, or officer who is listed with us as such. If you wish to give an employee, attorney, or accountant access to your tax

information, you must supply us with a power of attorney giving us the authority to release confidential information to them.

This publication is available upon request in alternative accessible format(s). TDD (800) 735-2966

MO 860-2350 (07-2012)

DOR 4098 (07-2012)

1

1 2

2