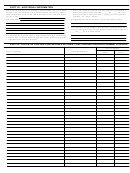

Form K-120 - Kansas Corporation Income Tax - 2000 Page 2

ADVERTISEMENT

Form K-120, page 2

Tax: Enter the taxable income from line 20 ____________________

21.

Normal tax (4% of line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22.

Surtax (3.35% of line 20 in excess of $50,000) . . . . . . . . . . . . . . . . . .

22

23.

23

Total tax (Add lines 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

V

24.

Total nonrefundable credits (Part I, line 12; cannot exceed amount on line 23) . . . . . . . . . . . . . . . . . . . . .

24

G

25.

Balance (Subtract line 24 from line 23; cannot be less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26.

Estimated tax paid and credit (Part II, line 4) . . . . . . . . . . . . . . . . . .

26

K

27.

Other tax payments (Separate schedule) . . . . . . . . . . . . . . . . . . . .

27

L

28.

Equipment property tax credit refund (See instructions) . . . . . . . . .

28

U

29.

Total of all other refundable credits (Part I, line 17. Do not include

29

W

the Equipment property tax credit refund amount) . . . . . . . . . . . . .

30

30.

Total prepaid credits (Add lines 26, 27, 28 and 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31.

Balance Due (If line 25 exceeds line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

32. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33. Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34. Estimated tax penalty

34

(If annualizing to compute penalty, check this box)

. . . . . . . .

35. Total tax, interest & penalty due (Add lines 31, 32, 33 and 34) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

36. Overpayment (If line 25 plus line 34 is less than line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

37. Amount of line 36 you wish to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

P

38. Amount of line 36 you wish to be credited to 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

Q

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct, and complete return.

sign

Signature of officer

Title

Date

here

Individual or firm signature of preparer

Address

Date

You are not required to send a copy of your entire federal return. See instructions for the list of federal forms that are

required to accompany the state return.

Mail this return and payment to:

Kansas Corporate Tax

Kansas Department of Revenue

915 SW Harrison Street

Topeka, KS 66699-4000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6