Form K-120 - Kansas Corporation Income Tax - 2000 Page 6

ADVERTISEMENT

PART VII - ADDITIONAL INFORMATION

1. Does the Kansas sales figure in Part VI include (1) all sales delivered from Kansas where

b. Has any state determined that this corporation conducts or has conducted a

unitary business with any other corporation?

_____ No

_____ Yes If yes,

purchaser is the U.S. Government and (2) all sales delivered from Kansas to states in

specify which state or states and enclose a complete list of the corporations

which this corporation is immune from state income taxation under Public Law 86-272

s s

conducting

the

unitary

business.

(15 U.S.C.

381) ?

If not, please explain

3. Describe briefly the nature and location(s) of your Kansas business activities.

4. Are the amounts in the total company column the same as those reported in returns

or reports to other states under the Uniform Division of Income for Tax Purposes Act?

_____ Yes _____ No. If no, please explain.

2. If you claim that part of your net income is assignable to business done outside Kansas:

a. Attach a list of all states in which this corporation is doing business and filing state

corporation income or franchise tax returns.

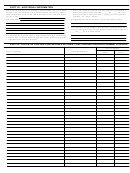

PART VIII - AFFILIATED CORPORATIONS INCLUDED IN FORM K-120AS CORPORATION APPORTIONMENT SCHEDULE

Check if included:

In Total Company

Within Kansas

Name of Corporation

Federal Identification #

Factors

Factors

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6