Form It-260 - Change Of Resident Status - Special Accruals

ADVERTISEMENT

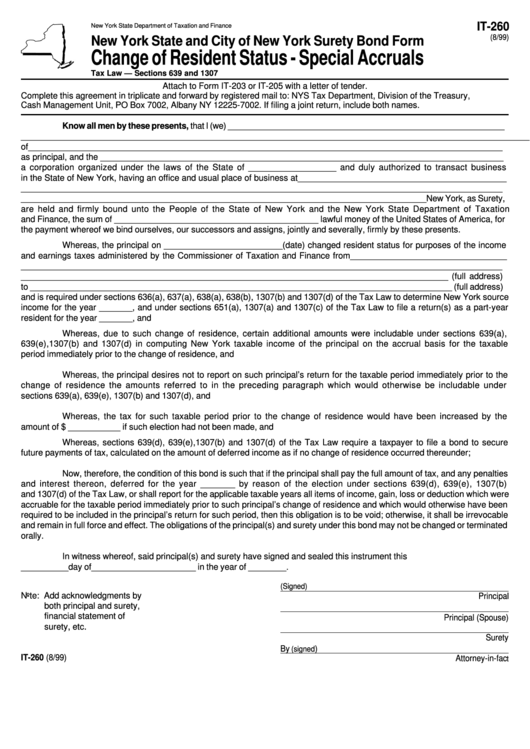

IT-260

New York State Department of Taxation and Finance

(8/99)

New York State and City of New York Surety Bond Form

Change of Resident Status - Special Accruals

Tax Law — Sections 639 and 1307

Attach to Form IT-203 or IT-205 with a letter of tender.

Complete this agreement in triplicate and forward by registered mail to: NYS Tax Department, Division of the Treasury,

Cash Management Unit, PO Box 7002, Albany NY 12225-7002. If filing a joint return, include both names.

Know all men by these presents, that I (we) ____________________________________________________________

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

of___________________________________________________________________________________________________

as principal, and the _____________________________________________________________________________________

a corporation organized under the laws of the State of __________________ and duly authorized to transact business

in the State of New York, having an office and usual place of business at____________________________________________

_______________________________________________________________________________________________________

______________________________________________________________________________________New York, as Surety,

are held and firmly bound unto the People of the State of New York and the New York State Department of Taxation

and Finance, the sum of ___________________________________________ lawful money of the United States of America, for

the payment whereof we bind ourselves, our successors and assigns, jointly and severally, firmly by these presents.

Whereas, the principal on _________________________(date) changed resident status for purposes of the income

and earnings taxes administered by the Commissioner of Taxation and Finance from_________________________________

___________________________________________________________________________________________________________

__________________________________________________________________________________________ (full address)

to _________________________________________________________________________________________ (full address)

and is required under sections 636(a), 637(a), 638(a), 638(b), 1307(b) and 1307(d) of the Tax Law to determine New York source

income for the year _______, and under sections 651(a), 1307(a) and 1307(c) of the Tax Law to file a return(s) as a part-year

resident for the year _______, and

Whereas, due to such change of residence, certain additional amounts were includable under sections 639(a),

639(e),1307(b) and 1307(d) in computing New York taxable income of the principal on the accrual basis for the taxable

period immediately prior to the change of residence, and

Whereas, the principal desires not to report on such principal’s return for the taxable period immediately prior to the

change of residence the amounts referred to in the preceding paragraph which would otherwise be includable under

sections 639(a), 639(e), 1307(b) and 1307(d), and

Whereas, the tax for such taxable period prior to the change of residence would have been increased by the

amount of $ ___________ if such election had not been made, and

Whereas, sections 639(d), 639(e),1307(b) and 1307(d) of the Tax Law require a taxpayer to file a bond to secure

future payments of tax, calculated on the amount of deferred income as if no change of residence occurred thereunder;

Now, therefore, the condition of this bond is such that if the principal shall pay the full amount of tax, and any penalties

and interest thereon, deferred for the year _______ by reason of the election under sections 639(d), 639(e), 1307(b)

and 1307(d) of the Tax Law, or shall report for the applicable taxable years all items of income, gain, loss or deduction which were

accruable for the taxable period immediately prior to such principal’s change of residence and which would otherwise have been

required to be included in the principal’s return for such period, then this obligation is to be void; otherwise, it shall be irrevocable

and remain in full force and effect. The obligations of the principal(s) and surety under this bond may not be changed or terminated

orally.

In witness whereof, said principal(s) and surety have signed and sealed this instrument this

__________day of______________________ in the year of ________.

(Signed)

Note: Add acknowledgments by

Principal

both principal and surety,

financial statement of

Principal (Spouse)

surety, etc.

Surety

By

)

(signed

IT-260 (8/99)

Attorney-in-fac

t

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1