Instructions For Futa Credit Reduction - 2012

ADVERTISEMENT

State of Michigan

Department of Licensing and

Regulatory Affairs

UNEMPLOYMENT

2012 FUTA Credit Reduction

INSURANCE

AGENCY

Normal FUTA Tax

,

R

S

Governor

Employers pay FUTA on the first $7,000 of each employee’s annual wages. The FUTA tax

ICK

NYDER

State of Michigan

was a flat rate of 6.2% up to June 30, 2011. As of July 1, 2011, the FUTA tax rate is 6.0%,

but employers who pay their state unemployment tax timely and in full will still receive a

Steven H. Hilfinger,

Director

Department of Licensing and

5.4% credit if their state is not a credit reduction state. Therefore, the net FUTA tax rate is

Regulatory Affairs

currently is 0.6%.

Steve Arwood

, Deputy Director

Department of Licensing and

Michigan is a Credit Reduction State

Regulatory Affairs

Federal law provides for a reduction in the FUTA tax credit when a state has outstanding

federal loans for two years. The reduction in the FUTA tax credit is 0.3% for the first year,

Steve Arwood

,

Director

Unemployment Insurance Agency

and an additional 0.3% for each succeeding year until the loan is repaid. 2011 is the third

year that Michigan has had an outstanding federal loan. The credit reduction for 2011,

which is due January 31, 2012, is 0.9%. Therefore, the net FUTA tax is 1.7%, prior to July

st

st

1

, (a maximum of $119 per employee) and 1.5% on or after July 1

, (a maximum of $105

per employee). The FUTA credit reduction results in a net increase in FUTA taxes and

applies to all Michigan contributing employers (except to Indian Tribes, nonprofit

organizations, and governmental entities).

The FUTA credit reduction resulted in an additional $21 per employee ($7,000 X 0.3% =

$21) in 2009 (first year loans were un-repaid), which reduced the FUTA credit to 5.1%. In

2010 (second year loans remained un-repaid), it cost Michigan employers an additional $42

per employee ($7,000 x 0.6% = $42), which reduced the FUTA credit to 4.8%. In 2012 (third

year loans will remain un-repaid), it will cost Michigan employers an additional $63 per

employee ($7000 x 0.9% = $63), which will reduce the FUTA credit to 4.5%.

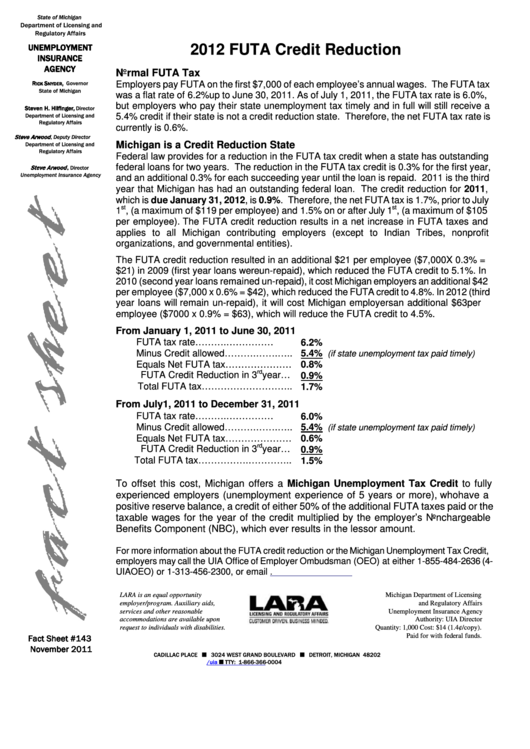

From January 1, 2011 to June 30, 2011

FUTA tax rate……….……………....... 6.2%

Minus Credit allowed……….…….….. 5.4%

(if state unemployment tax paid timely)

Equals Net FUTA tax………………… 0.8%

rd

FUTA Credit Reduction in 3

year… 0.9%

Total FUTA tax……………………….. 1.7%

From July1, 2011 to December 31, 2011

FUTA tax rate……….……………....... 6.0%

Minus Credit allowed……….…….….. 5.4%

(if state unemployment tax paid timely)

Equals Net FUTA tax………………… 0.6%

rd

FUTA Credit Reduction in 3

year… 0.9%

Total FUTA tax…………….………….. 1.5%

To offset this cost, Michigan offers a Michigan Unemployment Tax Credit to fully

experienced employers (unemployment experience of 5 years or more), who have a

positive reserve balance, a credit of either 50% of the additional FUTA taxes paid or the

taxable wages for the year of the credit multiplied by the employer’s Nonchargeable

Benefits Component (NBC), which ever results in the lessor amount.

For more information about the FUTA credit reduction or the Michigan Unemployment Tax Credit,

employers may call the UIA Office of Employer Ombudsman (OEO) at either 1-855-484-2636 (4-

UIAOEO) or 1-313-456-2300, or email OEO@michigan.gov.

LARA is an equal opportunity

Michigan Department of Licensing

employer/program. Auxiliary aids,

and Regulatory Affairs

services and other reasonable

Unemployment Insurance Agency

accommodations are available upon

Authority: UIA Director

request to individuals with disabilities.

Quantity: 1,000 Cost: $14 (1.4¢/copy).

Fact Sheet #143

Paid for with federal funds.

November 2011

CADILLAC PLACE 3024 WEST GRAND BOULEVARD DETROIT, MICHIGAN 48202

TTY: 1-866-366-0004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1