Instructions For Form Ri-1040c - 2012

ADVERTISEMENT

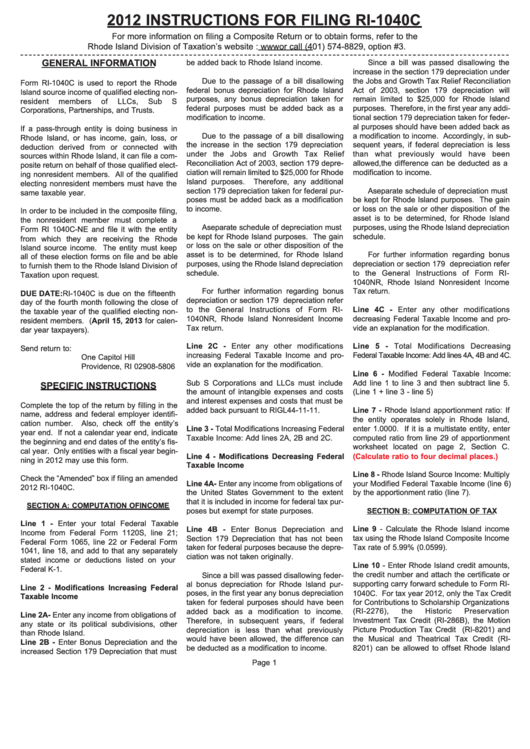

2012 INSTRUCTIONS FOR FILING RI-1040C

For more information on filing a Composite Return or to obtain forms, refer to the

Rhode Island Division of Taxation’s website : or call (401) 574-8829, option #3.

GENERAL INFORMATION

be added back to Rhode Island income.

Since a bill was passed disallowing the

increase in the section 179 depreciation under

Due to the passage of a bill disallowing

the Jobs and Growth Tax Relief Reconciliation

Form RI-1040C is used to report the Rhode

federal bonus depreciation for Rhode Island

Act of 2003, section 179 depreciation will

Island source income of qualified electing non-

purposes, any bonus depreciation taken for

remain limited to $25,000 for Rhode Island

resident

members

of

LLCs,

Sub

S

federal purposes must be added back as a

purposes. Therefore, in the first year any addi-

Corporations, Partnerships, and Trusts.

modification to income.

tional section 179 depreciation taken for feder-

al purposes should have been added back as

If a pass-through entity is doing business in

Due to the passage of a bill disallowing

a modification to income. Accordingly, in sub-

Rhode Island, or has income, gain, loss, or

the increase in the section 179 depreciation

sequent years, if federal depreciation is less

deduction derived from or connected with

under the Jobs and Growth Tax Relief

than what previously would have been

sources within Rhode Island, it can file a com-

Reconciliation Act of 2003, section 179 depre-

allowed, the difference can be deducted as a

posite return on behalf of those qualified elect-

ciation will remain limited to $25,000 for Rhode

modification to income.

ing nonresident members. All of the qualified

Island purposes.

Therefore, any additional

electing nonresident members must have the

section 179 depreciation taken for federal pur-

A separate schedule of depreciation must

same taxable year.

poses must be added back as a modification

be kept for Rhode Island purposes. The gain

to income.

or loss on the sale or other disposition of the

In order to be included in the composite filing,

asset is to be determined, for Rhode Island

the nonresident member must complete a

A separate schedule of depreciation must

purposes, using the Rhode Island depreciation

Form RI 1040C-NE and file it with the entity

be kept for Rhode Island purposes. The gain

schedule.

from which they are receiving the Rhode

or loss on the sale or other disposition of the

Island source income. The entity must keep

asset is to be determined, for Rhode Island

For further information regarding bonus

all of these election forms on file and be able

purposes, using the Rhode Island depreciation

depreciation or section 179 depreciation refer

to furnish them to the Rhode Island Division of

schedule.

to the General Instructions of Form RI-

Taxation upon request.

1040NR, Rhode Island Nonresident Income

For further information regarding bonus

Tax return.

DUE DATE: RI-1040C is due on the fifteenth

depreciation or section 179 depreciation refer

day of the fourth month following the close of

to the General Instructions of Form RI-

Line 4C - Enter any other modifications

the taxable year of the qualified electing non-

1040NR, Rhode Island Nonresident Income

decreasing Federal Taxable Income and pro-

resident members. (April 15, 2013 for calen-

Tax return.

vide an explanation for the modification.

dar year taxpayers).

Line 2C - Enter any other modifications

Line 5 - Total Modifications Decreasing

Send return to:

R.I. Division of Taxation

increasing Federal Taxable Income and pro-

Federal Taxable Income: Add lines 4A, 4B and 4C.

One Capitol Hill

vide an explanation for the modification.

Providence, RI 02908-5806

Line 6 - Modified Federal Taxable Income:

Sub S Corporations and LLCs must include

Add line 1 to line 3 and then subtract line 5.

SPECIFIC INSTRUCTIONS

the amount of intangible expenses and costs

(Line 1 + line 3 - line 5)

and interest expenses and costs that must be

Complete the top of the return by filling in the

added back pursuant to RIGL 44-11-11.

Line 7 - Rhode Island apportionment ratio: If

name, address and federal employer identifi-

the entity operates solely in Rhode Island,

cation number. Also, check off the entity’s

Line 3 - Total Modifications Increasing Federal

enter 1.0000. If it is a multistate entity, enter

year end. If not a calendar year end, indicate

Taxable Income: Add lines 2A, 2B and 2C.

computed ratio from line 29 of apportionment

the beginning and end dates of the entity’s fis-

worksheet located on page 2, Section C.

cal year. Only entities with a fiscal year begin-

Line 4 - Modifications Decreasing Federal

(Calculate ratio to four decimal places.)

ning in 2012 may use this form.

Taxable Income

Line 8 - Rhode Island Source Income: Multiply

Check the “Amended” box if filing an amended

Line 4A - Enter any income from obligations of

your Modified Federal Taxable Income (line 6)

2012 RI-1040C.

the United States Government to the extent

by the apportionment ratio (line 7).

that it is included in income for federal tax pur-

SECTION A: COMPUTATION OF INCOME

poses but exempt for state purposes.

SECTION B: COMPUTATION OF TAX

Line 1 - Enter your total Federal Taxable

Line 9 - Calculate the Rhode Island income

Line 4B - Enter Bonus Depreciation and

Income from Federal Form 1120S, line 21;

Section 179 Depreciation that has not been

tax using the Rhode Island Composite Income

Federal Form 1065, line 22 or Federal Form

taken for federal purposes because the depre-

Tax rate of 5.99% (0.0599).

1041, line 18, and add to that any separately

ciation was not taken originally.

stated income or deductions listed on your

Line 10 - Enter Rhode Island credit amounts,

Federal K-1.

the credit number and attach the certificate or

Since a bill was passed disallowing feder-

supporting carry forward schedule to Form RI-

al bonus depreciation for Rhode Island pur-

Line 2 - Modifications Increasing Federal

1040C. For tax year 2012, only the Tax Credit

poses, in the first year any bonus depreciation

Taxable Income

for Contributions to Scholarship Organizations

taken for federal purposes should have been

added back as a modification to income.

(RI-2276),

the

Historic

Preservation

Line 2A - Enter any income from obligations of

Therefore, in subsequent years, if federal

Investment Tax Credit (RI-286B), the Motion

any state or its political subdivisions, other

depreciation is less than what previously

Picture Production Tax Credit (RI-8201) and

than Rhode Island.

would have been allowed, the difference can

the Musical and Theatrical Tax Credit (RI-

Line 2B - Enter Bonus Depreciation and the

8201) can be allowed to offset Rhode Island

be deducted as a modification to income.

increased Section 179 Depreciation that must

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2