Instructions For Form 84 - Nebraska Motor Fuels Tax Refund Claim Page 2

ADVERTISEMENT

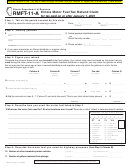

Refund Rate Table

The following rates should be used when claiming a refund of fuel tax paid on fuel used by an

exempt entity or for a qualified nontaxable use. The refund is claimed on a Form 84.

For 2004, the table reflects the refund rates for claimants whose fiscal year ends on December

31. Claimants whose fiscal year ends on a date other than December 31 should contact the Motor

Fuels Division for the appropriate 2004 refund rates.

Diesel Fuels

Gasoline, Gasohol, Ethanol

Petroleum Release Remedial Action Fee

Aircraft Fuels

Federal Gov=t;

Federal Gov=t;

Gasoline,

Native American;

Other

Native American;

Other

Gasohol,

Diesel, Jet

Aviation

Purchase Date

Exports

Users

Exports

Users

Aviation Gasoline

Ethanol

Fuel

Gasoline

Jet Fuel

07/01/03->12/31/03

.246

.246

.246

N/A

.009

N/A

.003

.05

.03

01/01/04->06/30/04

.248

.248

.248

N/A

.009

N/A

.003

.05

.03

07/01/04->12/31/04

.248

.248

.248

N/A

.009

N/A

.003

.05

.03

01/01/05->06/30/05

.254

.244

.254

.219

.009

.009

.003

.05

.03

07/01/05->12/31/05

.253

.243

.253

.218

.009

.009

.003

.05

.03

01/01/06->06/30/06

.261

.251

.261

.226

.009

.009

.003

.05

.03

07/01/06->12/31/06

.271

.261

.271

.236

.009

.009

.003

.05

.03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2