Form Vm-2 - Virginia Vending Machine Dealer'S Sales Tax Return - 2002 - Portrait Page 2

ADVERTISEMENT

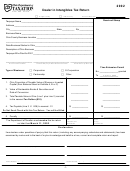

DEALER’S WORKSHEET FOR COMPUTING TAX

ON SALES THROUGH VENDING MACHINES

Form VM-2A

(For use by dealers engaged in the business of placing vending

Read Instructions on

Preserve this Work

machines through which they sell tangible personal property)

Sheet as part of your

reverse side before

Sales Tax Records

preparing this Work Sheet

DEALER’S NAME ______________________________________ ACCT. NUMBER ___________________

ADDRESS ____________________________________________ FILING PERIOD ___________________

A. ITEM

B. STATE

C. LOCAL

1. Cost price and/or manufactured cost of tangible personal property sold through

1.

1.

vending machines (See Instructions).

2. Allowable deductions:

a. Cost price and/or manufactured cost of tangible personal property sold

2a.

2a.

through vending machines during this period and returned by purchaser

during this period, if included in Item 1 (See Instructions).

b. Cost price and/or manufactured cost of tangible personal property sold

2b.

2b.

through vending machines and returned during this period on which tax

was paid in a prior period (See Instructions).

c. Other deductions.

2c.

2c.

d. Total deductions (Sum of Items 2a, 2b and 2c).

2d.

2d.

3. Item 1 less Item 2d (Compute tax on this amount).

3.

3.

4. Tax (State — 4 % of Item 3, Col. B; Local — 1% of Item 3, Col. C).

4.

4.

5a. Dealer’s Discount. Add the cost of goods sold (Item 3, Column B) from each 5a.

return you are required to file for this period. Use this total cost of goods

sold figure and the chart below to determine the appropriate discount rate.

DEALER’S

Enter the discount rate on Line 5a.

ENTER

DISCOUNT

DEALER’S

TOTAL MONTHLY COST OF GOODS SOLD

APPLIES TO

FROM ALL LOCATIONS

DEALER’S DISCOUNT RATE

DISCOUNT RATE

STATE TAX ONLY

ABOVE

IS AT LEAST

BUT LESS THAN

$0

$62,501

.0356

$62,501

$208,001

.0267

$208,001

.0178

5b. Multiply Item 4, Column B by the applicable discount rate determined above.

5b.

6. Item 4 less Item 5b.

6.

6.

7. Penalty for late filing and payment (See Instructions).

7.

7.

8. Interest for late filing and payment (See Instructions).

8.

8.

9. Total tax, penalty and interest (Sum of Items 6, 7 and 8).

9.

9.

10.

10. Amount due (Sum of Item 9, Columns B and C).

____________________________________

____________________

(Signature)

(Date)

COMPLETE THIS WORK SHEET AND TRANSFER ITEMS INDICATED BY THE ARROWS TO

CORRESPONDING ITEM NUMBERS ON TAX RETURN (FORM VM-2)

DEALER’S DISCOUNT ALLOWABLE ONLY WHEN RETURN AND PAYMENT ARE FILED ON TIME

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2