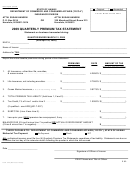

Form 314 - Annual Premium Tax Statement - 2013 Page 4

ADVERTISEMENT

Name of Insurer

EXHIBIT NO.:

4

INFORMATION:

Premium Tax Statement for the Year Ended December 31, 2013

APPLICABLE TO:

ALL INSURERS

Round All Amounts to Nearest Dollar

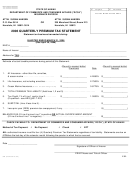

DETAIL OF CREDITS AND PAYMENTS

PLEASE PROVIDE COMPLETE SUPPORT FOR ANY CREDIT TAKEN

CREDITS:

Hawaii Life & Disability Insurance Guaranty

Association Assessments . . . . . . . . . . . .

$ _NONE__________________

Tax Credit to Facilitate Regulatory Oversight

(If qualified---see HRS §431:7-207) . . . . . .

$ ________________________

___________________________________ . . .

$ ________________________

___________________________________ . . .

$ ________________________

___________________________________ . . .

$ ________________________

1.

TOTAL CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ________________________

(to line 5, page 1)

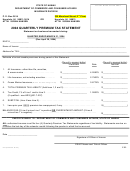

PAYMENTS:

MONTHLY Premium Tax Payments for 2013:

MONTH Ended JANUARY 31, 2013

$

MONTH Ended FEBRUARY 28, 2013

$

MONTH Ended MARCH 31, 2013

$

MONTH Ended APRIL 30, 2013

$

MONTH Ended MAY 31, 2013

$

MONTH Ended JUNE 30, 2013

$

MONTH Ended JULY 31, 2013

$

MONTH Ended AUGUST 31, 2013

$

MONTH Ended SEPTEMBER 30, 2013

$

MONTH Ended OCTOBER 31, 2013

$

MONTH Ended NOVEMBER 30, 2013

$

MONTH Ended DECEMBER 31, 2013

$

AMENDED Month Ended

$

AMENDED Month Ended

$

AMENDED Month Ended

$

AMENDED Month Ended

$

$__________________________

TOTAL MONTHLY Premium Tax Payments for 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2012 PRIOR YEAR Premium Tax Overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$__________________________

If AMENDED filing, amount paid with ORIGINAL filing . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$__________________________

2.

TOTAL PAYMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ________________________

(to line 7, page 1)

COMPLETE EVERY ITEM OF EACH EXHIBIT. Enter “NONE” where no entries are to be made.

REMINDERS BEFORE MAILING:

1.

Tax Statement signed AND dated by a duly authorized officer of the Company?

2.

Total payments include the last monthly tax payment? [December 31, 2013 - due January 20, 2014]

3.

Carry forward the correct prior year overpayment? If the Tax Statement was amended, carry

forward the amended prior year overpayment amount.

4.

ROUND TO NEAREST DOLLAR ALL AMOUNTS REPORTED ON THE TAX STATEMENT.

5.

Premium tax payments should be made payable to: DEPARTMENT OF COMMERCE AND

CONSUMER AFFAIRS (“DCCA”), STATE OF HAWAII.

6.

Pages 1 through 4 of the Tax Statement are required. File page 5 (Supplemental Schedule A) ONLY

if applicable --- if Schedule A is NONE, do not file page 5.

7.

Form must be on LEGAL SIZE PAPER --- LETTER SIZE WILL NOT BE ACCEPTED.

8.

Correct insurer address? ALL TAX RELATED CORRESPONDENCE from the Hawaii Insurance

Division will be sent to the address listed on page 1 of the Tax Statement.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5